Apr 8, 2021 | Articles

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Dear Clients,

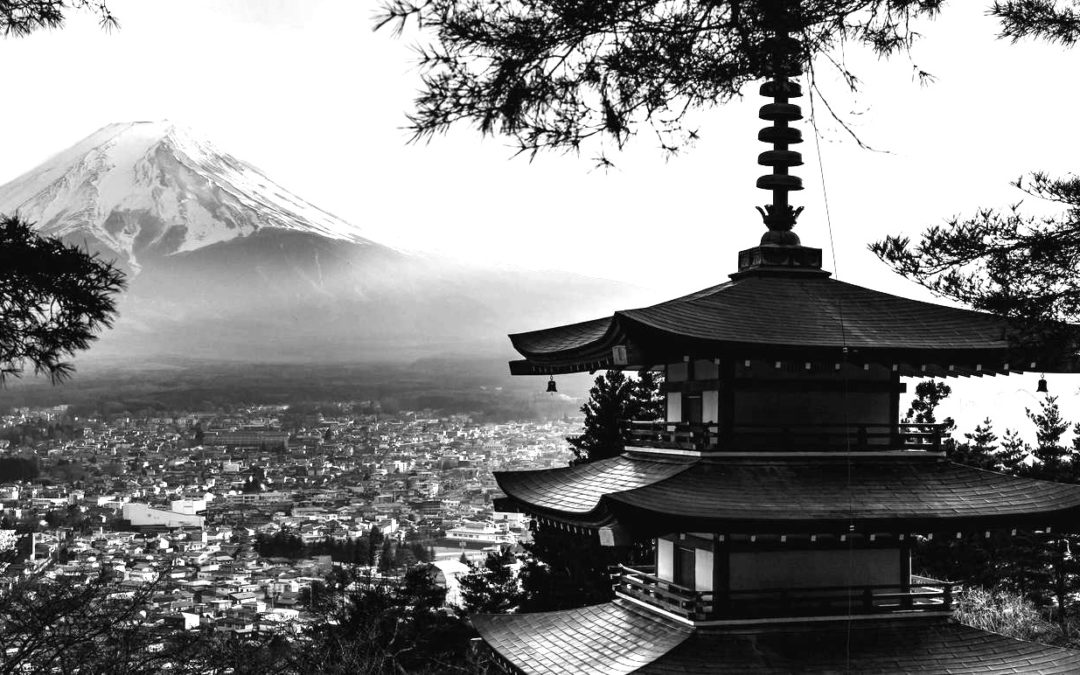

Our Japanese Real Estate team are delighted to bring you the third and final instalment of our Thought Leadership series looking at a key investment asset within our portfolios; Japanese boutique hotels or “Ryokan’s” as they are known in Japan. Part Three presents our investment case and takes you through a variety of case studies that have informed our view and decision making when investing into Ryokan’s. We hope that this final instalment brings together the theory we discussed in Part One and Part Two and helps you understand why we find Ryokan’s such a compelling asset.

Our Thought Leadership Series on Ryokan’s includes the following topics:

Part One: What are Ryokan’s, how do they operate and what are the key features?

Part Two: Sector Analysis – what are the emerging trends, dynamics and unique selling points of Ryokans?

Part Three: Investment Thesis & Case Study of Ryokans

If you like to receive more information, please contact:

James Wheeler

Managing Director – Head of Distribution

james.wheeler@odyssey-grp.com

www.odyssey-grp.com

Apr 1, 2021 | Articles

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Dear Clients,

Our Japanese Real Estate team are delighted to bring to you Part Two of our Thought Leadership series looking at a key investment asset within our portfolios; Japanese boutique hotels or “Ryokan’s” as they are known in Japan. Part Two takes a deep dive and analyses the emerging trends, dynamics and unique features of Ryokans and what makes them such a compelling asset. Our Thought Leadership series on Ryokan’s includes the following topics:

Part One: What are Ryokan’s, how do they operate and what are the key features?

Part Two: Sector Analysis – what are the emerging trends, dynamics and unique selling points of Ryokans?

Part Three: Investment thesis and case study of Ryokans

We hope you find Part Two interesting and a fascinating continuation into understanding the world of Ryokan’s. We have linked Part One again here for those who may have missed this, and we looked forward to sharing Part Three next week.

If you like to receive more information, please contact:

James Wheeler

Managing Director – Head of Distribution

james.wheeler@odyssey-grp.com

www.odyssey-grp.com

Mar 26, 2021 | Articles

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Dear Clients,

As we move towards the official launch of our second fund which invests into Japanese hospitality real estate in early April, our Japanese Real Estate team have prepared the first of a three part thought leadership series looking at a key investment asset within our portfolios; Japanese boutique hotels or “Ryokan’s” as they are known in Japan. Over the coming weeks we will explore Ryokan’s and our goal is to help our investors to develop a greater understanding of these traditional and very unique hospitality assets found throughout Japan. Starting with today, and continuing over the coming weeks, our series on Ryokan’s will feature the following topics:

Part One: What are Ryokan’s, how do they operate and what are the key features?

Part Two: Sector Analysis – what are the emerging trends, dynamics and unique selling points of Ryokans?

Part Three: Investment thesis and case study of Ryokans

We hope you find part one interesting and informative first step into understanding the world of Ryokan’s and we look forward to sharing parts two and three soon.

Please click here to access Part One: What are Ryokan’s, how do they operate and what are the key features?

If you like to receive more information, please contact:

James Wheeler

Managing Director – Head of Distribution

james.wheeler@odyssey-grp.com

www.odyssey-grp.com

Mar 10, 2021 | Articles, Global Markets Update

March 2021 Insight

Inflation is a Dirty Word

If there was one factor that could knock the rally in risk assets on its head is the specter of inflation. That would remove the easy money that has been fueling markets. Right now, it is just the speculation of inflation as indicated by moves in the 5Y treasuries and beyond. Certainly, we have seen some positive inflation in recent data, and that’s a good thing. If we didn’t, it would mean the global economy was not recovering and the markets would have something far worse to contemplate. Indeed, if the recovery accelerates with the distribution of vaccines, headline inflation (CPI) may well surpass the often quoted 2% target in the next couple of quarters term due to low comparisons in Q2 2020 when US CPI fell close to zero. Further, the World Commodity Index has surged 63% since April 2020, which represents large rises in energy and raw material prices.

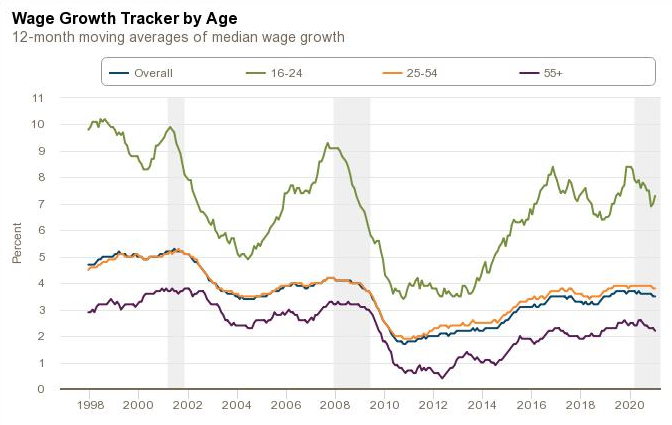

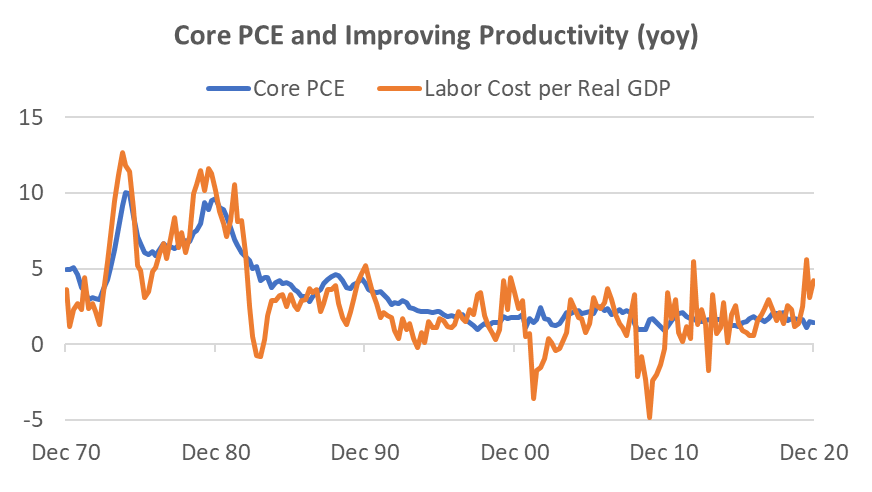

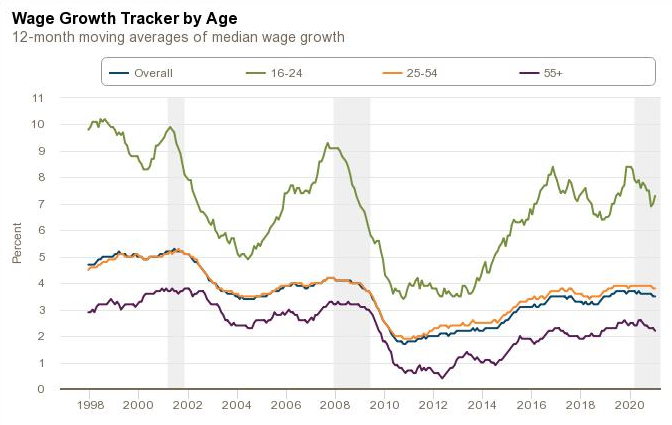

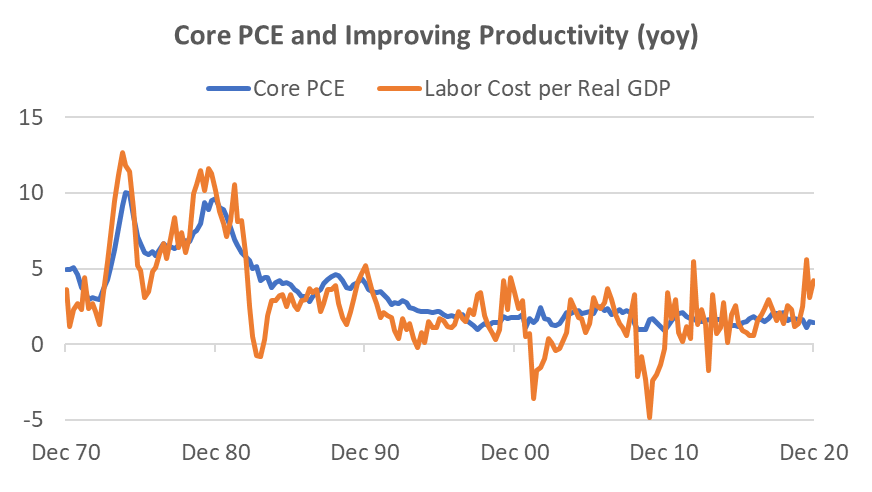

While headline inflation may cause concern for markets, most governments base monetary policy on some form of core inflation that often excludes food and energy prices. The US Fed favours the Core Personal Consumption Expenditure (PCE) Index as one its measures and this has not been above 2.5% since 1993. Indeed, there has been a falling trend in the PCE over the last 50 years and this unsurprisingly has coincided with the fall in unit labor costs per real GDP. The only time it has sustained above 2% for any length of time in the last 25 years was during the credit bubble of 2004-2008 when it was continually just above 2%. What has been driving this disinflation? My own opinion is that the root cause is accelerating technology adoption and diminishing wage growth due to an ageing working population. In 1999, workers of age 55+ were just 12.7% of the workforce. By 2019 this had almost doubled to 23.4% and by 2029 the U.S. Bureau of Labor Statistics forecast this age group to comprise 25.2% of the workforce.

Source: Federal Reserve Bank of Atlanta

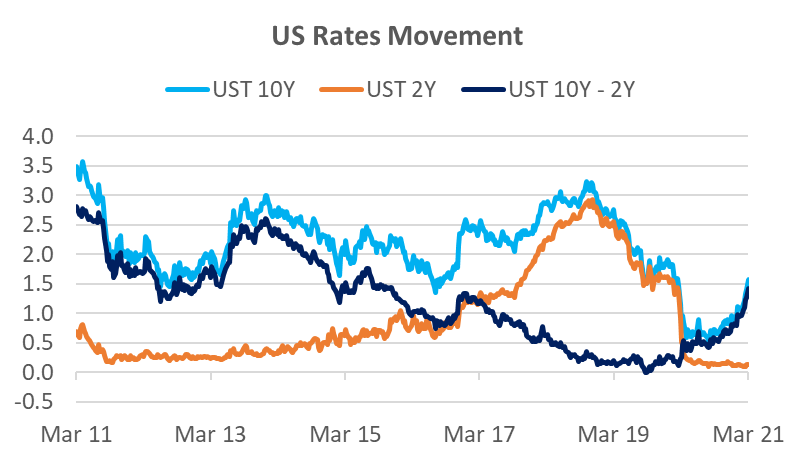

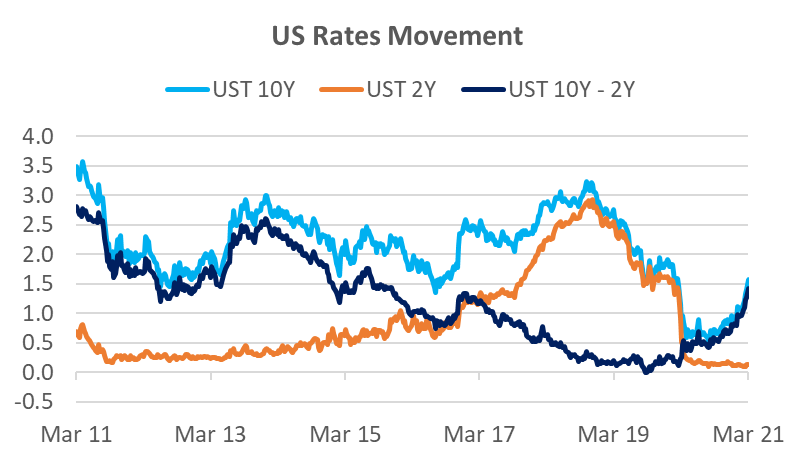

Since I am expecting these root forces to continue, it is not expected that the PCE Index to sustain above 2% for an extended time. From the Fed’s dovish comments, we appear to agree. However, the US yield curve is pricing in a rate hike as early as 2023 which is obviously earlier than the Fed’s expectation. Apart from jaw-boning, there is little the Fed can do to affect pricing several years beyond the target rate. The current 2Y-10Y differential is at 1.45%, above the previous spike of 1.34% in December 2016 and close to a potential resistance at 1.5%. Prior to that we had spikes to 1.76% in June 2015 and 2.61% in December 2013. In terms of absolute level of the 10Y UST, the 1.59% yield is similar to that in 2016 and 2012.

Source: Bloomberg

Source: Bloomberg, Odyssey

The Pain Trade in Rates

Several generations of bond traders have made fortunes from being long bonds – making money from when bond yields fall. That is because this has been the trend for three decades. Few traders like to short bonds, because they are betting against the trend. In addition to the specter of inflation, rising bond yields can have significant momentum for a time; everyone is betting in one direction and with significant leverage (often 10x or more). As the bond yields rise and prices fall, it becomes a pain trade for bond traders, and it ends up being a scramble to close out their long positions. The other marginal large player in rates are the large CTA (commodity trading advisors) funds that are followers of directional trends. Commentary suggest they close out their long bond positions in January and started to build up short positions in February. Trend algorithms do not have a human trader’s reticence or care about fundamentals.

Usually when bond yields rise, bond traders have an inkling that either inflation is rising faster than expected or that the government is about to alter monetary policy. In this case, we have only glimpsed the barest evidence of inflation and the Fed has been steadfast in its monetary policy. This is a reason why the bond market and equity investors have been caught a little off-guard, and probably why yields have been higher than what might be expected from fundamentals. Are yields heading even higher? Since the answer appears more technical rather than fundamental, then the short answer is that it is certainly possible.

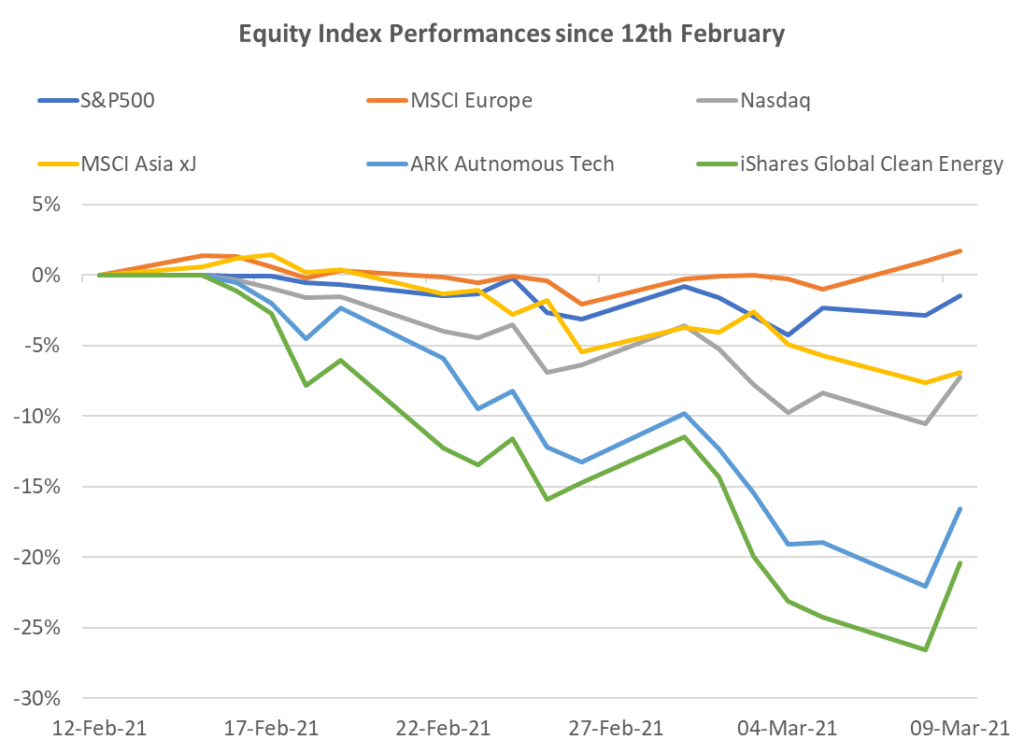

Dealing with Adjustment Pains

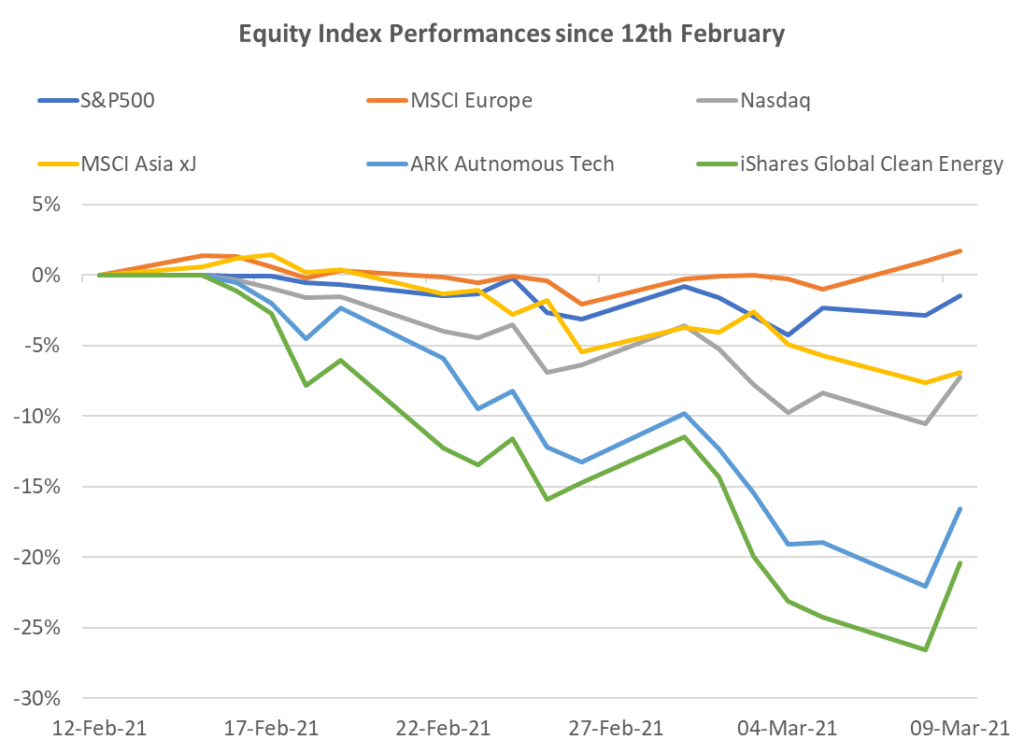

It is not helpful when a market commentator says that the current clearing out in stocks is good for medium and long-term returns when you are losing money. The good news is that blue-chip stocks have been highly resilient. The S&P500 is down less than 3% from its peak and major European burses have hardly moved. In fact, US Value stocks continued to climb another 3% since the S&P500 peak and Banks are up +9%. It’s been the high growth and speculative stocks that have suffered. The Nasdaq has fallen 10% and MSCI China has fallen 16%. Speculative ETFs have fallen 20-30%. In terms of technicals, it’s worth noting that the Nasdaq has hit it’s 100-day moving average. However, the trend of the UST 10Y is likely to remain a major factor.

Source: Bloomberg, Odyssey

Mixed Bag in Other Markets

We have been warning about the temptation to buy long duration credit for yield since November last year. The Global Corporate Credit Index is down -4% YTD and US Investment Grade is down -5%. Global HY is largely flat YTD due to lower duration and assisted by a higher carry.

The one asset class that has unequivocally benefitted from the stronger economic outlook has been commodities. The London Metals Index is up +9% YTD, with copper up +14%. WTI Oil is +14% YTD and has moved in virtually a straight line up since the beginning of the year. The main commodity to suffer has been gold which is down -7% YTD and has lost some of its lustre due to the popularity of cryptocurrencies.

Investment Recommendations

When Boring is Good

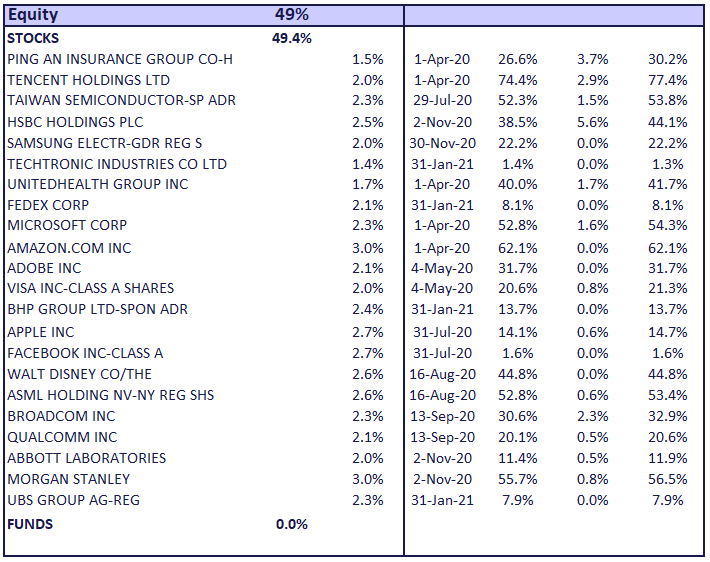

Back in November 2020 when the Value v Growth issue in stocks first arose, we chose a slightly different tact. We suggested a 3 stock basket that was non-tech and seemed to perform in a steady fashion regardless of whether Value or Growth was favoured. The basket comprised UnitedHealth, Abbott Labs and Morgan Stanley. Since the end of November, the basket is up +14% and up +2% since the recent peak of the SPX500 on February 12. These have not been flashy stocks but together they would have helped to stabilize any equity portfolio and provided significantly better than market returns. All three have announced solid Q4 operational results and we have no qualms about continuing to recommend these stocks, particularly as a basket.

Value in Tech Yet?

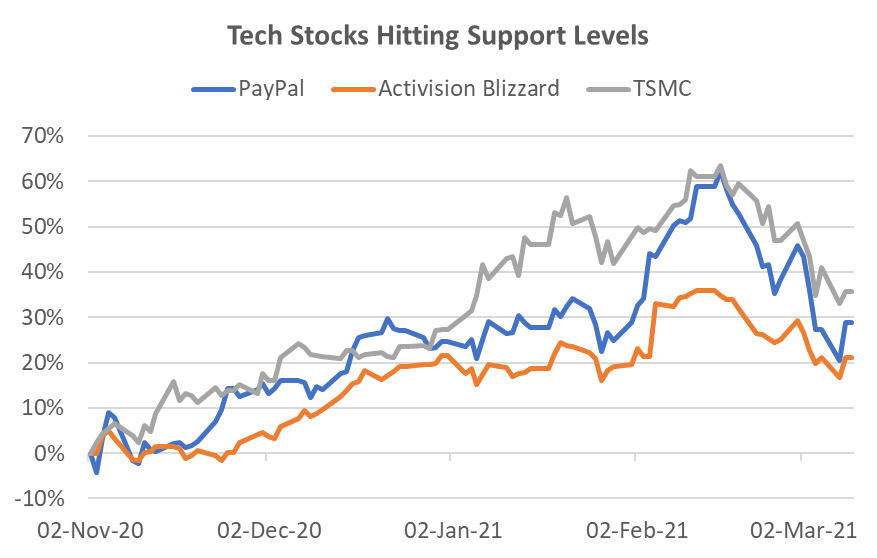

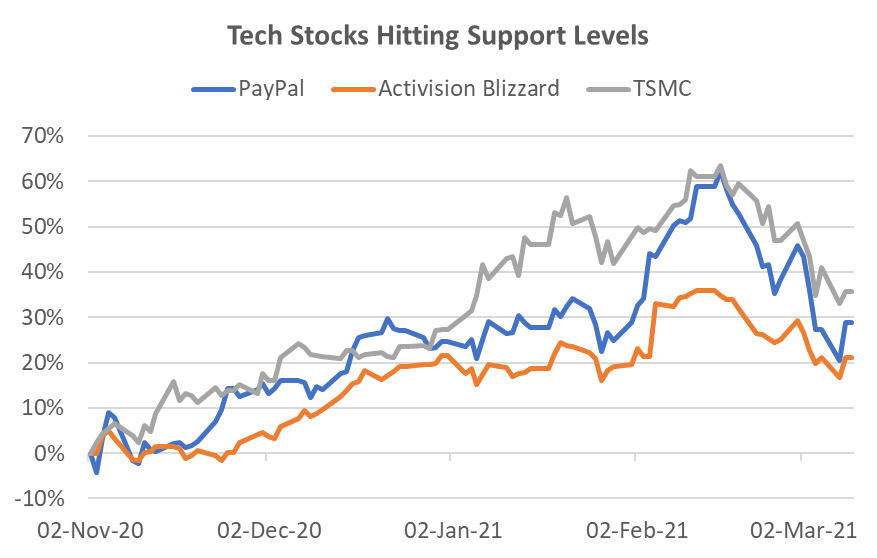

Despite the recent 10% fall in the US Infotech sector, the 1-year forward PER at 30x remains 40% higher than the 10-year average at 21x. Some of this is due to the 41% weight to Apple and Microsoft, but there is no denying the sector remains expensive. Nevertheless, the US Infotech sector has hit the 100-day moving average and if we can get some respite from rising rates, the potential for a technical bounce is possible. There are plenty of stocks that we have previously recommended that had very strong Q4 results but have fallen 20-25% to what appears to be technical support levels. These include Paypal, Activision Blizzard, and TSMC to name just three. However, to find one that is trading close to pre-COVID valuations is more difficult.

Source: Bloomberg, Odyssey

One such stock is Google. We rarely featured this FAANMG last year because its peers were overshadowing its performance, but the last two quarters have seen a marked operational improvement to firmly catch up with its peers. It has been a major beneficiary of the recovery in online advertising spend, but it is not burdened with as many political and sentiment issues as Facebook. In particular, its Youtube business has been riding a wave of popularity, and with a new product suite, the 45% revenue growth in Q4 2020 is expected to remain strong. Further, while Amazon and Microsoft continue to dominate cloud infrastructure, Google Cloud’s large customer acquisition program has started to improve, demonstrated by 46% revenue growth. Finally, Search remained a very solid performer with 17% revenue growth. At a valuation of 29x 2021 earnings, the stock is trading only slightly high to its usual range of 25-30x over the last 5 years. The stock has shown resilience during the growth sell-off and has only fallen 4% from market peak to trough.

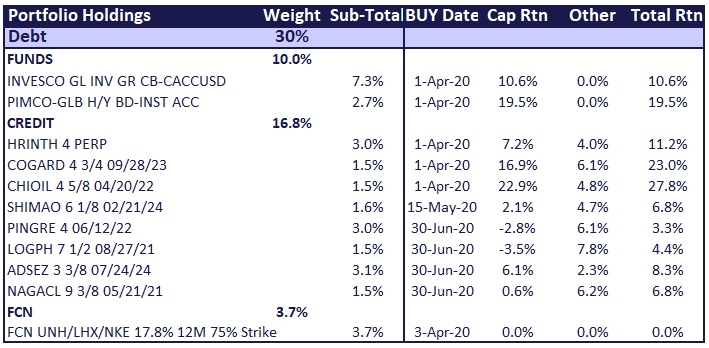

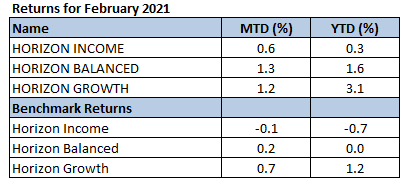

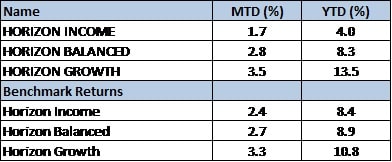

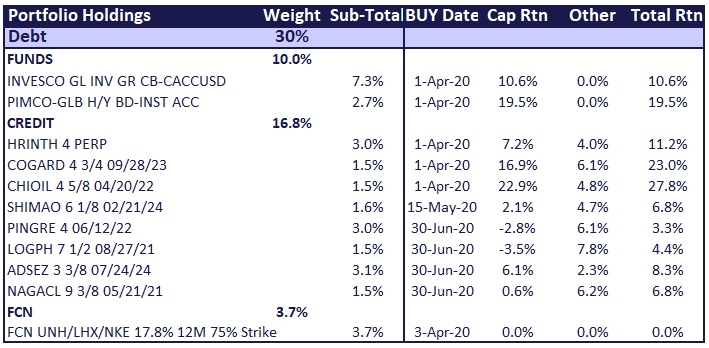

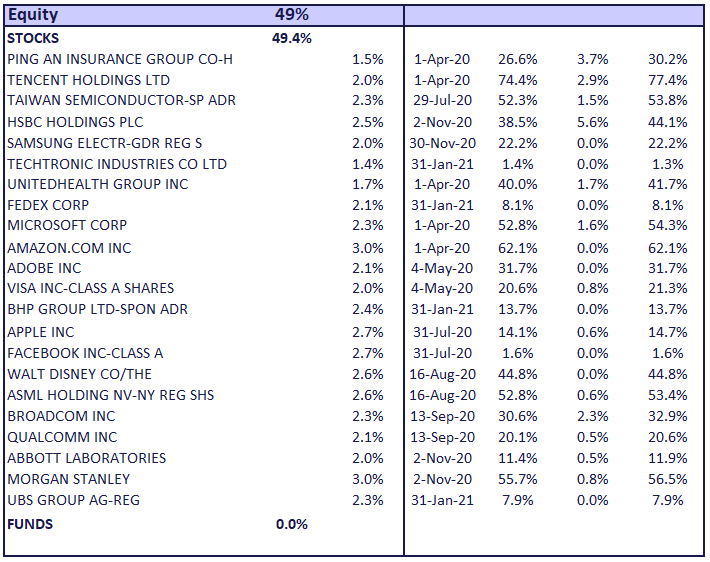

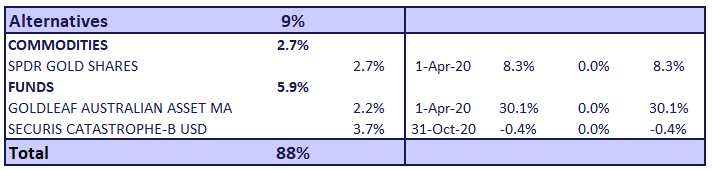

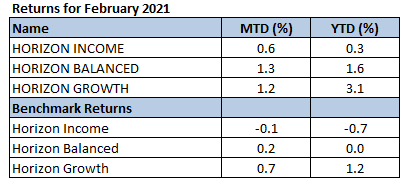

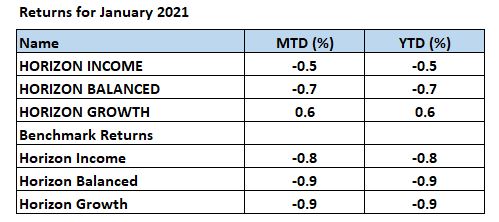

Odyssey Model Portfolio Performance

Horizon Performance

If you like to receive more information on our portfolios solutions, please contact us here: info@odyssey-grp.com.

Feb 10, 2021 | Articles, Global Markets Update

February Market View

Wall Street meets Social Media

The evolution of social media has turned into a revolution for the financial markets. Ten years ago, the mostly forgotten Arab Spring showed how nascent social media could galvanise the populace to cause social and political change. More recently we’ve seen social media propel the #MeToo movement, Donald Trump tweeting over 26,000 times as the POTUS and often using it to announce official news, Russia being accused of using social media to affect the 2016 US elections, as well as being used in the recent protest on Capital Hill. Now the financial markets are experiencing how effective social media can be in moving asset prices.

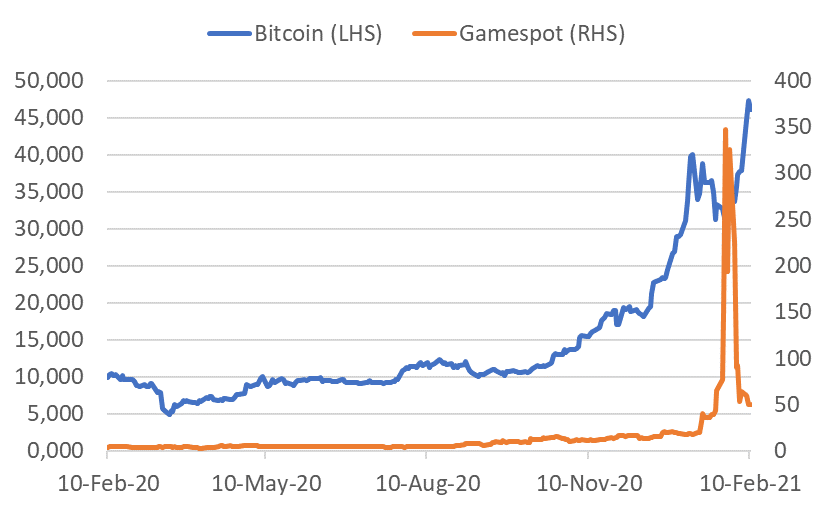

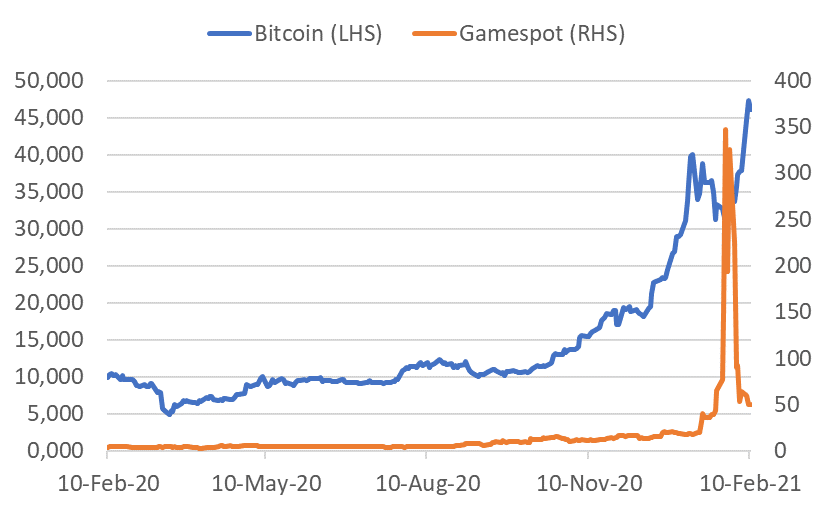

Chart: Bitcoin and Gamespot price

Source: Bloomberg

Dramatic price moves have occurred in Gamestop, AMC, and now Bitcoin through actions on social media. What does the increase in the use of social media platforms bode for investing? The use of social media for investment research has been prevalent for close to a decade. The rise of the “retail” or DIY investor can be seen by the massive growth fund flow to ETFs at the expense of the active manager. In recent months, the move has also transferred to individual stocks and stock options and this has been cited as a major reason behind the rally since November.

Chart: Net Call Option buys with less than 10 contracts on individual equities

Source: J.P. Morgan

The strength of the retail buying may be a major factor in market direction, at least in the short term. However, for most of us, monitoring retail flows may not be convenient or timely. What may be of use is the knowledge that this recent input to flows could lead to (and has led to) movements in stocks and ETFs to levels that defy valuation. On the flip side, when a popular stock disappoints, it could lead to buying opportunities as buyers hollow out. While most studies have focused on the impact of social media on small cap stocks, it would not surprise if retail also had an appreciable impact on popular big-cap stocks. Perhaps it was a factor Apple’s surge in August last year and subsequent fall in September. In short, we have seen and can continue to expect excessive movements that could lead to both buying and selling opportunities as stocks rise and fall in popularity.

Who will Blink?

Bears keep pointing to sky-high equity valuations, a very hot IPO market, record volumes, and the parabolic performance of certain thematic baskets where the majority of companies are unprofitable. Bulls see a recovering economy, particularly in the US, unprecedented stimulus, zero interest rates for the foreseeable future, the fastest vaccine rollout in history, and negligible inflation. As a short-term fillip, with over half the S&P500 companies having reported, 80% have beaten the consensus EPS estimate, and by a whopping 19%, with a 4% topline surprise. The story is similar in Europe and Japan, albeit to a lesser degree.

For the moment, the bulls are winning and as we saw in the 1990’s, a frothy market can last for longer than many bears can hold out. Nevertheless, we make no prediction on short-term direction, but suggest clients to analyse stocks at face value. For instance, on the claim there is a lack of inexpensive stocks, we propose three big cap examples – UnitedHealth, Qualcomm and FedEx. All have forward PERs in the teens and are expected to report robust operational numbers this year with or without COVID. Facebook is also worth mentioning with a forward PER that is below the S&P500 average. This is the first time that has occurred since Facebook listed in 2012. These are not poorly performing stocks – they have all outperformed the S&P500 over the last 12 months. However, you could say they are currently a little out of favour. This segues back to our earlier suggestion that the retail trade can well help to provide opportunities to buy quality stocks that are unpopular.

Chart: Performance of Select Inexpensive stocks

Source: Bloomberg, Odyssey

Horizon Performance

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

Jan 8, 2021 | Articles, Global Markets Update

January Market View

Equity Market Recovery – Historical Context

The very optimistic November market sentiment carried over to December. Again, all risk assets recorded robust gains, albeit at a lower rate than the previous month. The big question now is whether the strong momentum shown in the last two months can carry over into the New Year.

“Unprecedented” is a word often used about the COVID crisis and certainly most of us have never experienced a similar situation. While it is also an unprecedented situation for the financial markets, broad equity index performances have certainly experienced a similar backdrop. In the last 50 years we have seen a similar rate of recovery from market lows three times – from September 1974, July 1982, and of course from February 2009 during the GFC. It is interesting to note that in these three periods, and indeed for the recovery of all seven previous drawdowns in the last 50 years of greater than 20%, that there appears a significant resistance level after the MSCI World Index approaches 40-50% recovery. Ominously, we are about there now in this recovery.

Source: Bloomberg, Odyssey

As market veterans realise, every situation is slightly different, and this time may end up reacting very different than history. However, markets also do tend to repeat themselves in a broad sense. At the end of the day, none of us have a crystal ball, so we advise investors not to get caught up with the hype and stay disciplined with their risk allocations and investment decisions.

The short-term question is what the January performance will look like and whether that is a harbinger for 2021 performance. While there is plenty of statistical evidence for “Sell in May and Go Away” until November, the evidence for January is less clear cut. In the last 50 years, the proportion of times both January and the full year return was positive is just 54%. You don’t need to run the stats on that to realize the two are not correlated. The proportion of times that January is positive is 64%, again hardly something to get excited about. Compare that to the 78% of years where the month of December is positive.

Why is the Equity Market so Much Higher than pre-COVID?

The simple answer is valuation multiple expansion. Optimists may say that valuation multiples should be high at the bottom of the economic cycle and low at the top. This phenomenon can be seen in many cyclical industries. However, for the market as a whole, there is little empirical evidence for this. The only time we have seen forward PER estimates this high was during the Dotcom boom and that was a speculative rally. Under this scenario, stock prices rise if the gain in EPS is higher than the fall in the EPS multiple. How does the maths stack up when looking at the S&P500 and consensus EPS forecasts? The S&P500 is trading on a next year (2022) forward PE multiple of 19.5x. This is 32% higher than the 13.3x multiple in 2010-2015 period in the years when the market was climbing out of the GFC when we also had zero interest rates. The market is expecting earnings growth to slow in 2022. If we assume this as peak cycle, we would expect the forward PE ratio to fall at least back towards the average of 13.3x, if not below. This means 2022 EPS expectations need to be 42% higher than 2020 level and 22% higher than the very strong 2019 level in order for the market to merely stay flat. This appears a tough ask.

However, should the market believe a higher market multiple is justifiable for longer, then the reliance on EPS growth is lower. This situation may play out should the recovery appear strong in 2021, providing the expectation strong growth will remain for 2022. Periods of high valuations can persist, as they did in the late 1990s, and while they have historically always reverted to mean, the timing is difficult to predict.

Source: Bloomberg

Diminishing Choices

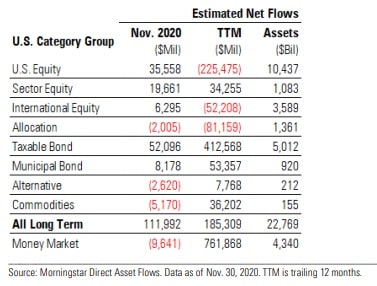

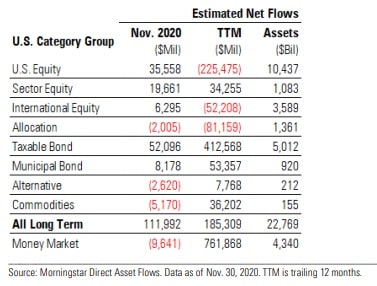

Since the trough of the equity market in March 2020, the MSCI World Total Return Index has surged by a staggering 70%. However, despite positive inflows in November after the US elections, US equity has experienced fund outflows in a trend that has persisted since 2015. In the liquid space the main beneficiary has been credit and in the illiquid space, while transactions have slowed significantly, the growing popularity of private equity, credit and real estate appears undiminished.

The positive takeaway from this for equity markets is that it appears investors are underweight equity, and its most liquid rival for fund flow, bonds, is providing a historically low yield. The Bloomberg Barclays Global Credit Index is currently yielding 1.4%. It is doubtful many investors, private or institutional, would be satisfied with that return, even for a relatively “safe” asset class.

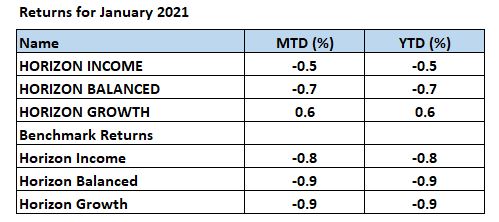

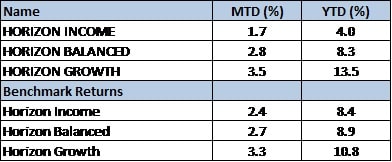

Performances

December Returns

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com