May 14, 2019 | Articles, Global Markets Update

April found equities in good health, led up by the S&P 500 (+3.93% MoM) and followed by Stoxx (+3.23% MoM) on a combination of trade optimism, ‘dovish’ central banks’ rhetoric and better earnings off Q1FY19 results. Asia ex-Japan (AXJ)/Emerging markets (EM) equities lagged as USD strengthened and Q1 earnings were mixed, although Chinese equities saw a robust ‘beat’ on Q1FY19 results. Fixed income (FI) continued to see inflows to higher quality bonds as parts of the market worried about the risks in credit from a pick-up in defaults. 10y US Treasury (UST) yields recovered from recent lows at around 2.30% to trade in a range of 2.50% to 2.60%, and the UST 2y/10y spread widened out to 23.6bps, dampening talk of an imminent recession after yield curves inverted briefly.

FX saw volatility in several EM currencies around domestic political troubles including Turkey, Argentina – Peso fell to an all-time low – and Brazil. DXY gained through the month on relatively better US macro data relative to other developed markets (DM) and Powell was seen to be more ‘hawkish’ after last week’s Federal Open Market Committee (FOMC) meeting. GBP tested lows at 1.2900 but recovered over the last week to regain the 200DMA support after the Conservative party lost badly in the local elections, spurring hopes they might be more willing to compromise and reach an agreement with the Labour party. The Brent oil price tested 6-month highs above $75/brl after the US ended waivers for countries importing oil from Iran but signs of OPEC+ disunity, notably with Russia, and rising US oil inventories saw the price retreat towards support at $70/brl. Gold moved inversely to USD strength and higher UST yields to fall back below $1,300/Oz and test support at $1,270-80/Oz.

The key decision regarding risk assets is whether Trump and subsequently Lighthizer, are bluffing when threatening to impose 25% tariffs across all imports from China (including $325bn of tariffs they’ve not imposed so far) this Friday. US equities, USD and Gold’s immediate reaction suggests the base case is it is a bluff. Reading various US brokerages on the threat, most seemed to agree with the ‘bluff’ thesis too, with a view neither USA nor China, and that neither Trump nor Xi, want to let a deal fail given the economic and political damage of a failure at this stage. There was one exception to the ‘bluff’ thesis that noted – after contacting people known to them within the US administration’s trade team – that the US had become annoyed by China’s recent reversal on certain agreed points and remained stubborn over key issues such as subsidies to state-owned enterprises, technology transfers and its ‘Made in China’ industrial policies. The piece suggested that, rather than a bluff, the US was deadly serious, and this is a very real breakdown. We would not dismiss this alternative thesis out of hand. We have reiterated several times there was a material risk, about 30% to 40%, a deal would not happen in H1CY19 given the red lines for both countries and the political need for both Trump and Xi to satisfy domestic audiences. On top, in the US, there is clearly a view this is the US’s best opportunity to challenge China’s trade practices and require structural changes before it is too late.

On a medium basis, assuming the trade news works its way out, there are two more fundamental risks, to our cautious view. The first is that Q1 EPS results materially ‘beat’ lowered consensus, hence resulting in decent upgrades to earnings forecasts (ERR). ERRs have been falling for several months, with S&P 500 Q1 consensus cut by over 10% from levels forecasted at the end of September ’18, so it is of note that LGT thinks the ERR for S&P 500 ticked up since results started. S&P 500 has moved sideways since results began, with top-line numbers mostly below expectations, but strong results from the likes of Facebook and Microsoft helped US equities.

The second risk is that falling GDP forecasts stabilise, or even get revised upwards. Thus, it is of interest that Goldman Sachs (GS) have raised their US GDP forecast for ’19 and ’20 to 2.4% and 2.5% (GS rightly noted, if they were to be right, that this might suggest the Fed has become overly cautious). Likewise, sell-sides strategists are noting that China’s reflation is working, and both UBS and HSBC have revised forecasts up to 6.5% for ’19 from 6.2%. Separately, GS sees EU GDP stabilising in Q2 whilst UBS thinks Q1 numbers will surprise to the upside. Overall, GS thinks the global economy will recover from Q2 onwards and pick-up into H2. Should ERRs inflect positively and GS be correct about the imminent recovery in GDP, then equities will be able to ‘bridge across’ to a better H2 and the rally could continue, although it implies UST will sell off. Both Credit Suisse (CS) and UBS have increased their equity allocations last week for the reasons above.

However, the ’bridge’ argument is not our base case. We see a correction as quite possible and have some sympathy with a John Auters piece that argued markets have rebounded too quickly from the sell-off in Q4. He thinks that valuations are not supportive, that we are later in the economic cycle and that he thinks the next move will be to correct sharply again. John suggests markets are more like a boy on the slide and that he will slide down again once he gets to the top. We have completed – fast – a perfect slide to the bottom and then back to the top since September. We are more in the ‘slide’ camp than the bridge over to a better H2, but are well aware there’s a danger of underestimating the resilience of S&P 500 earnings and the strength of the US economy (and at the same time overestimating the same for Europe and Stoxx). The old adage, ‘Sell in May and go away’, might have more relevance this year again!

Given it is a 50/50 bet as to whether Trump is bluffing or not, it would be foolish to be buying into these moderate declines outside A-shares. We had deliberately built up cash levels across portfolios YTD and thus are decently defensively positioned. This month, as noted before, is quite perilous so acting too quickly is likely to be a mistake. For now, we will ride the volatility and not do too much.

Equities

-

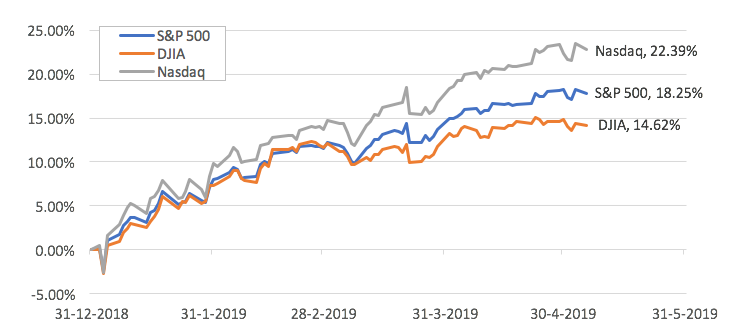

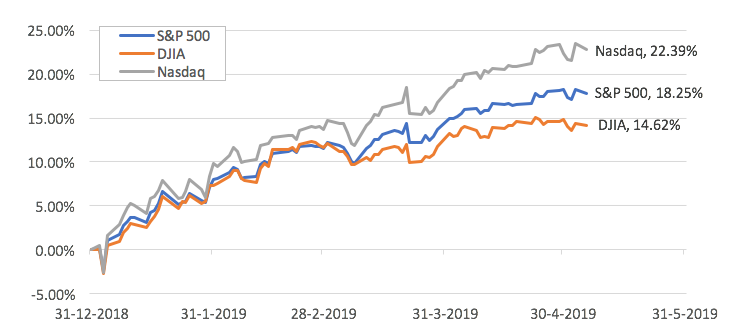

Shares in the US continued their steady climb into the midst of earnings season, with the S&P 500 (+3.93% MoM) and Nasdaq (+4.74% MoM) inching into all-time high territory, while the Dow Jones Industrial Average (DJIA) (+2.56% MoM) has come close despite having lagged YTD (Figure 1). This underperformance has been largely led by earnings’ disappointments in blue chips like 3M and Intel, but also as shares in index heavyweight Boeing suffered amidst uncertainty around the 737 MAX.

Figure 1 Total returns YTD of major US indices Source: Bloomberg

-

As of 3rd May, 78% of companies in the S&P 500 have reported earnings for 1Q19, 76% (above historical average) of which have reported aggregate earnings beat while 60% (mostly in-line with the historical average) reported a positive revenue surprise. So far this quarter, the index is tracking a -0.8% earnings decline which will mark the first YoY decline in earnings for the index since 2Q16.

-

The key data release this month was a 1Q19 GDP surprise, coming in at +3.2% against estimates of a +2.3% increase, though this was mostly driven by ‘transitory’ factors related to trade and inventory which added an estimated 1% to the headline figure. Stripping these anomalies out might suggest a reading that was mostly in-line if not slightly lower-than-expected, although we would highlight that Q1 data has had a major problem with accuracy for years.

-

US-China trade news will dictate the shorter-term outlook for the S&P 500. Our base case is that a deal will be struck as it is in the economic interest of both countries, and the political interests of both Trump and Xi, to do so. However, both sides have ‘red lines’ and there is a material chance, perhaps as high as 30-40%, a deal cannot be agreed upon, and that the US will impose 25% tariffs across all imports from China.

-

Additionally, Trump must, by 18th May, decide whether to impose auto tariffs on global imports to the US. We think he might hold-off doing so to Japan as both countries are in talks, but it is highly probable Trump will impose tariffs on EU with Germany a notable target, although we think a resolution could be quite fast. In the event of a resurgence in trade tensions, the S&P 500 will prove relatively defensive.

-

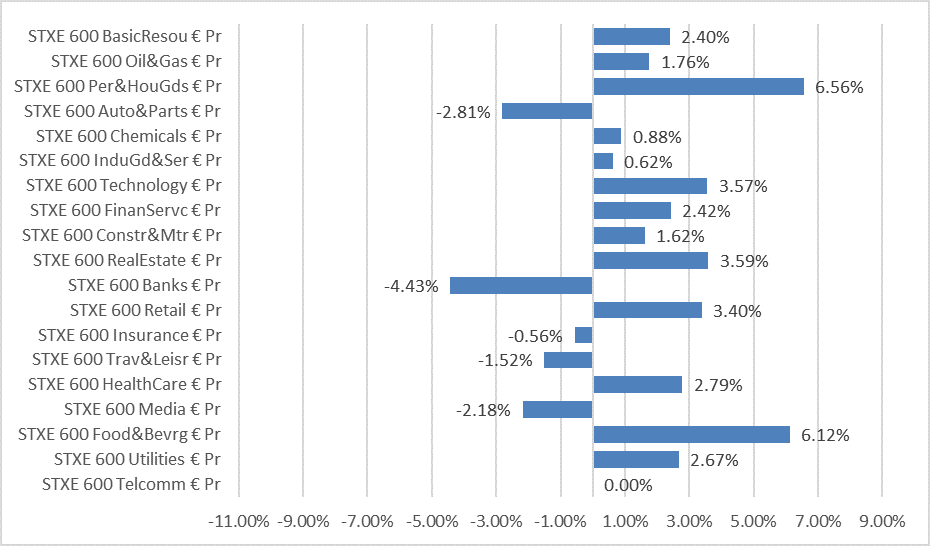

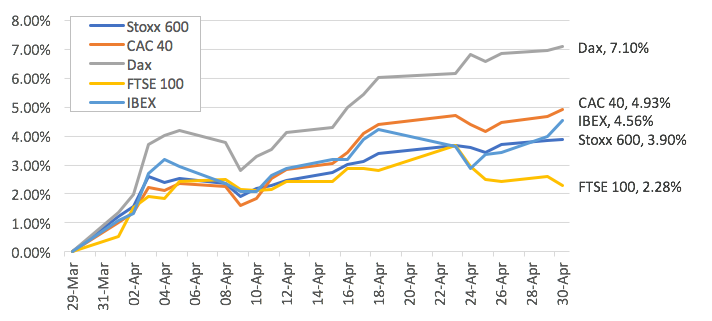

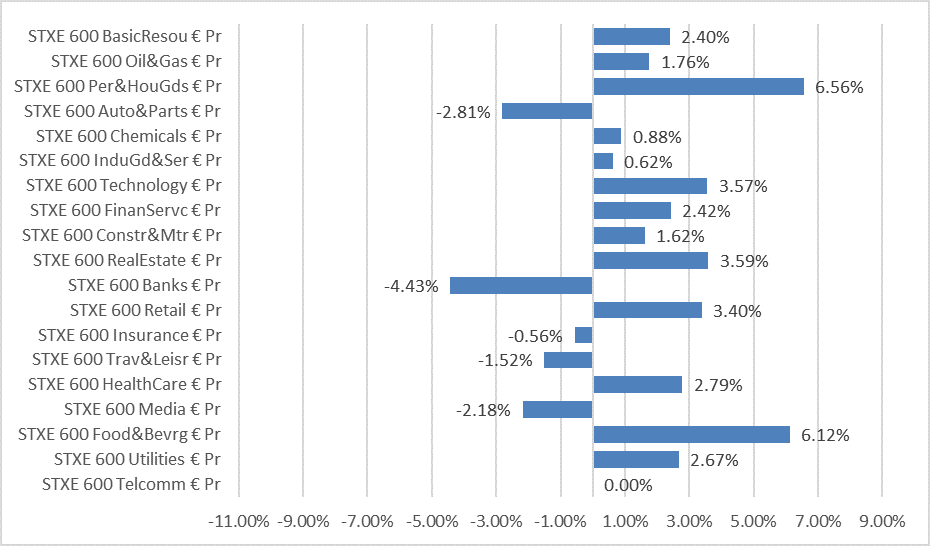

European equities followed their US counterparts higher in April but led by a steep recovery in Autos (+9.31% MoM), and sizeable gains in the Technology (+7.68% MoM), Banks (+7.54% MoM) and Industrials (+7.28% MoM) sectors. Defensives like Health Care (-1.90% MoM), Real Estate (-1.21%), Telcos (-0.64%) and Utilities (-0.34%) underperformed amidst the broader market rally.

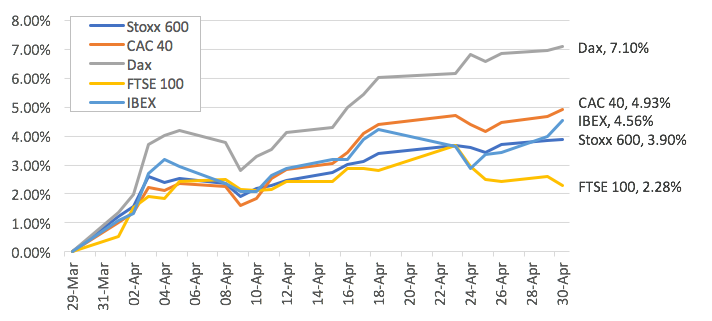

Figure 2: Stoxx 600 Total returns against EU indices in April Source: Bloomberg

Figure 2: Stoxx 600 Total returns against EU indices in April Source: Bloomberg

-

Across indices in the region (Figure 2), the German DAX (+7.10% MoM) was a clear outperformer on a total return basis, followed by the French CAC 40 (+4.93% MoM) and while Spain’s IBEX (+4.56% MoM). Despite more confirmation around a Brexit delay and as tail risks of a ‘hard Brexit’ subsided, the FTSE 100 (+2.28% MoM) still underperformed quite significantly in April.

-

After the ECB turned markedly more ‘dovish’ last month, helping fuel a rally in Stoxx and a weaker Euro, attention going forward will be on what action this might imply with some more bearish strategists anticipating ECB may have to resume QE before the year-end given a weak EU economy.

-

Stoxx earnings revisions saw the strongest pick-up in the last week in over ten months and Q1FY19 might be the best quarter for results in two years. It remains to be seen if actual results confirm this recent optimism that appears at odds with very weak economic data – especially in exports and manufacturing.

-

The hope is the weakness in the EU economy will be temporary and more a short-term cyclical downturn in manufacturing that is linked to trade disputes and that China’s reflation, with a three to six months lag, will show up in better EU data during Q2. However, if the US-China trade deal fails and the US imposes auto tariffs on EU, an industry which employs over 1mn people in Germany alone, it is possible EU could fall into a recession.

-

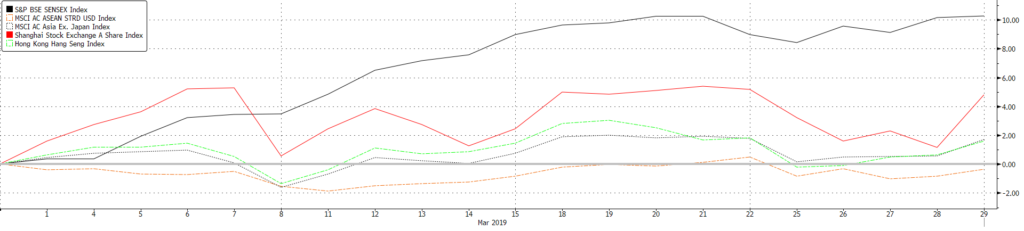

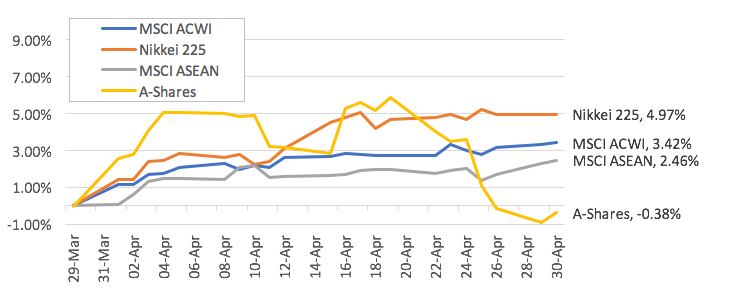

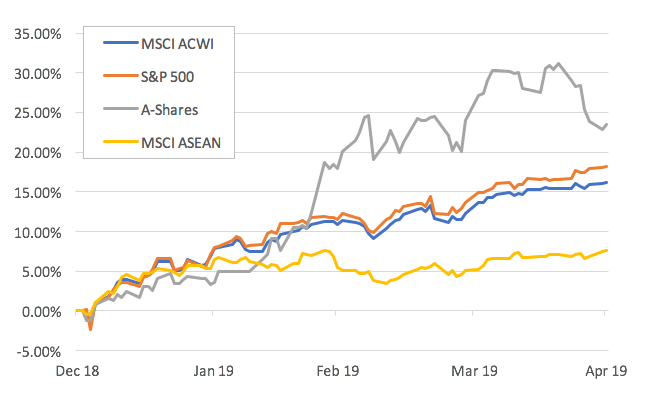

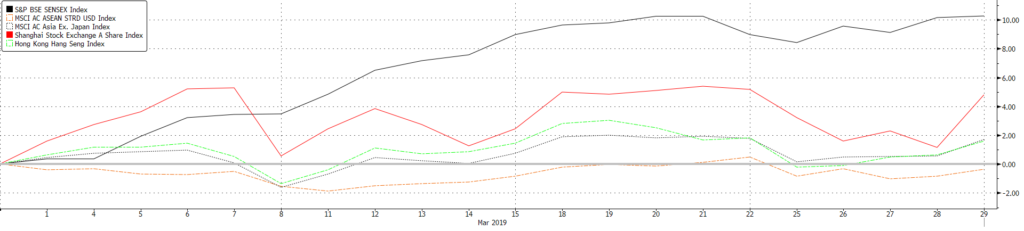

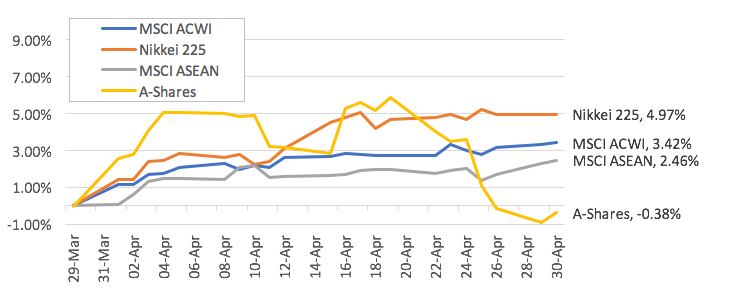

In Asia (and amongst the bigger global indices), Japan’s Nikkei (+4.97% MoM) has been the quiet outperformer ahead of their ‘Golden Week’ holiday which ran from April 27th to May 6th, while the Shanghai Composite Index (-0.38% MoM) closed the month flat despite having pushed YTD highs over the course of this month (Figure 3).

Figure 3: Underperformance of A-shares in April Source: Bloomberg

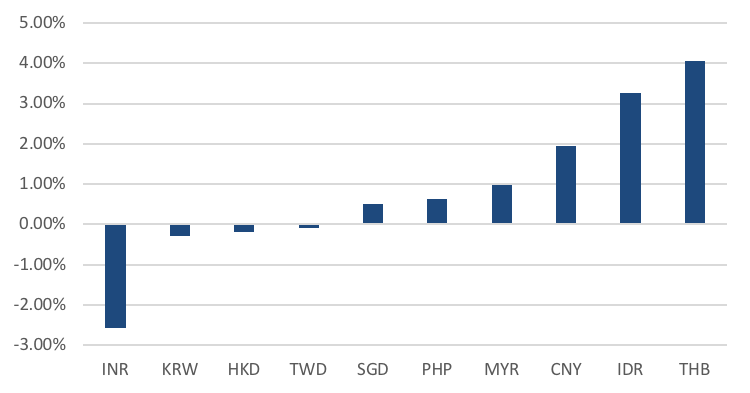

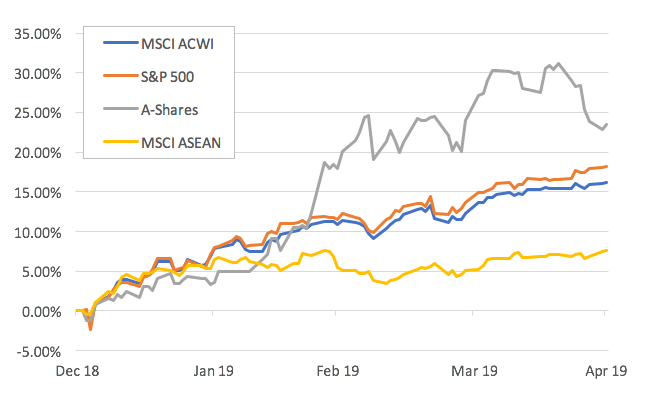

- ASEAN countries were also noticeably weak, and have been an underperformer so far this year, not least weighed down by continued strength in the US Dollar and relatively higher oil prices (Figure 4).

Figure 4: YTD underperformance of MSCI AC ASEAN Index Source: Bloomberg

Figure 4: YTD underperformance of MSCI AC ASEAN Index Source: Bloomberg

-

With 40% of MSCI China and 100% of A-shares having reported Q1FY19 results, the weighted median company ‘beat’ was 8%+ and the best quarterly results since Q2FY18, although this follows-on from Q4FY18 where profits fell 44% YoY. These robust results will support Chinese equities as the market offering the best EPS growth of any major market this year at +11% and these may be revised up as tax cuts, boosting profitability and consumption, started on 1st May. Outside of China, early AXJ/EM results have been quite mixed and the bias overall is disappointing so far.

-

May will be a key month for elections in Asia ex-Japan. We get results in Thailand on the 9th (there is a risk they are annulled), Philippines Senate elections, Indonesia by the 22nd – Jokowi is likely to win by 8-10% and that is positive for local equities – and India on 23rd. Of these, the Thai and Indian elections have binary implications for markets – the risk for India’s risk assets, and INR, is the BJP loses substantial ground (in UP it may lose 48 seats to end up with 30 of the 80 seats in the lower house) that it can only form a weak coalition government dependent on unreliable regional parties and that Modi is replaced as Prime Minister.

Fixed Income

-

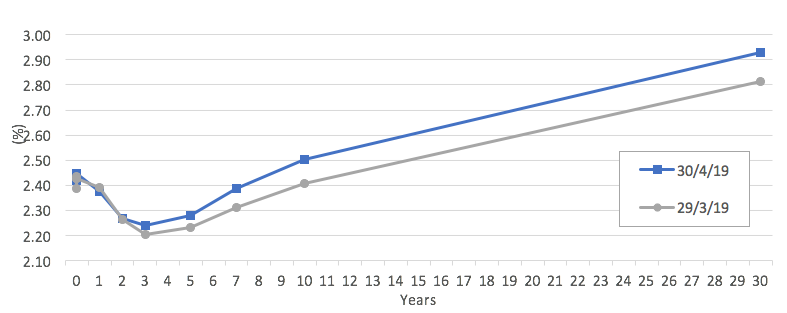

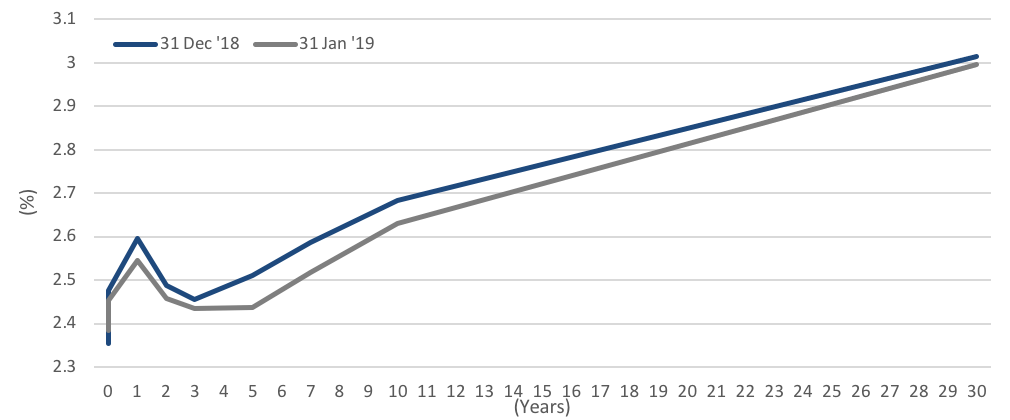

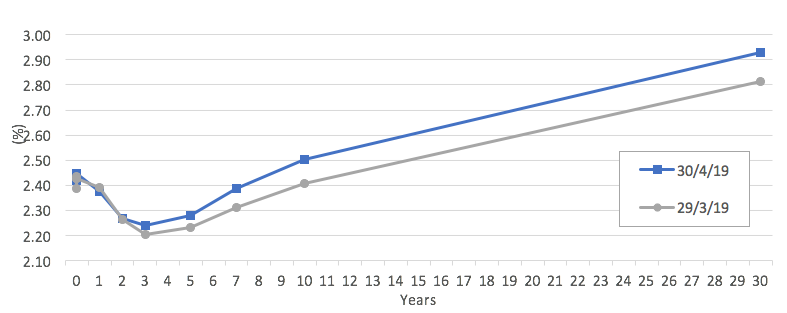

Sovereign rates were largely driven by economic data in April. A mixed bag of results over the month saw UST yields trade within a 20bps range throughout the period. However, the UST yield curve shifted upwards from the belly of the curve all the way to the long-end, thanks to support from strong manufacturing PMIs at the start of the month. Larger shifts were seen in the long-end, with the 10y and 30y yields rising 9.7bps and 11.4bps MoM respectively (Figure 5). This led to the yield curve steepening, with the 2y/10y spread rising from 14.3bps at the end of March to 23.6bps by the end of April. Similarly, the 5y/30y spread rose from 58.1bps to 65bps while the 3m/10y spread rose from 1.7bps to 8.5bps.

Figure 5: Upward shift in the yield curve in April Source: Bloomberg

-

European sovereign yields also received a boost at the start of the month after a stronger Chinese manufacturing PMI raised hopes that Europe will benefit from a stronger Chinese economy. However, mixed data thereafter led the Bunds yield to repeatedly test the 0% level through the month. There was only one instance of a significant break above the 0% level after better-than-expected economic data, but the yield failed to sustain the break and fell back towards the 0% level. Bunds yield ended the month 8.3bps higher MoM.

-

US high-yield (HY) was the best performing FI sector. US HY debt gained 1.42% MoM in April amid a supply shortage. Issuance in April was at $17bn – the lowest YTD. According to Bloomberg, most deals were oversubscribed, by multiple times with almost all trading above the issue price. April also saw the first PIK offering, hence suggesting that investors might be beginning to be more open to riskier assets and possibly explaining why the CCC space (+2.03% MoM) was the best performing sector within US HY (Figure 6).

Figure 6: CCC outperforms all other HY sectors Source: Bloomberg

-

Trade tensions could well see 10y UST retest the YTD low and key resistance at 2.30% after breaking below the 2.50% support post-Trump’s tariff threats. Likewise, Bunds 10y yield might go back into negative territory – not least if the US imposes auto tariffs in next week or so.

-

There are two major areas of concern in credit should a recession occur and default rates rise, with the first being the huge amount of debt (c$2.2trn) in the BBB space that accounts for 50% of total US IG outstandings. Some are speculating up to $1trn of this is vulnerable to being downgraded to junk that would be disruptive given existing HY FI outstandings of around $1trn. CLOs are the other area of rising concern given that the amount issued is similar to HY FI after huge new issuances in the last two years, but the danger is much of this is poorer quality paper (84% is covenant-light) by highly leveraged companies often (over 6x EBITDA). In contrast, HY FI credit fundamentals are improving as companies deleverage, reduce new issuance and use new debt to refinance more expensive, older debt.

-

We continue to highlight, in contrast to the perception EM FI is riskier, that the better credit fundamentals of EM FI – be it sovereign or corporate credit – are being underestimated. EM has lower debt to GDP than DM while EM corporates are deleveraging faster than DM corporates. Debt servicing drivers are also stronger, and demographics are superior to DM where the latter face genuine risks of unsustainable fiscal deficits in the future from unviable pension obligations and entitlements and limited political will to tackle the unpopular choices to rectify the imbalances. We remain positive, structurally, on EM FI with our preferred exposures in shorter duration EM HY FI. We would not chase it should spreads fall further but are comfortable collecting the coupon.

FX

-

Volatility in the G7 pairs recovered slightly in April due to AUD and GBP. The Fed continued to remain dovish however the dollar continued to display strength on the back of strong housing and employment data. The DXY traded to a 2-year high of 98.33 on the 26th April, breaking a resistance of 97.70 and is currently maintaining at this level. The biggest winners in April were EM currencies as investors were attracted to yields.

-

At the beginning of May, the trade-spat spooked investors. This caused indices to dip lower and JPY to strengthen as investors looked for haven assets. April remained a quiet month except for this, along with AUD and GBP.

-

EUR continued its long-term downtrend this month against a stronger USD as traders focused on disappointing industrial data from Germany and strong US consumer data. EUR ended April flat at -0.03%.

-

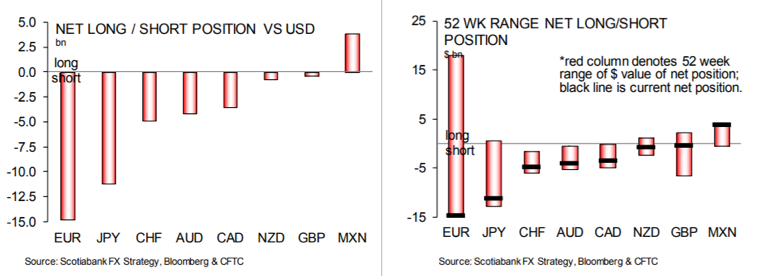

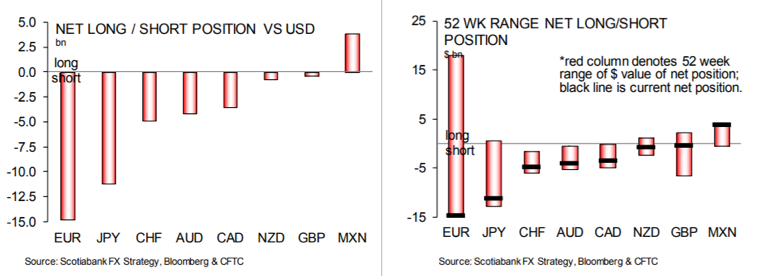

Within a 52-week range, CFTC reports show the EUR remains the largest net short hold with JPY and CHF near their largest net short hold. MXN remains net long as investors seek returns from interest rates.

Figure 7: CFTC 52W net-short positions

-

DXY broke out above resistance at 97.50 to climb above 98 and a test of previous strong resistance at 100.50 was on the cards but recent events have seen it retrace back to 97.50 acting now as key support. The underlying trend for DXY remains up still and so a retest of 100.50 level remains the base case. We are USD ‘bulls’ until it is evident we should not be – not least because most other DM currencies all appear to be less liked be it housing crises weakening the CAD and AUD; weak data impacting EUR and JPY; political headwinds exist for several EM currencies.

-

We expect the EU-wide election to be the next major test of the EUR hovering around key support at 1.12 as strong gains by anti-populist parties could see it break below 1.11 and possibly test stronger support in the 1.07-1.08 range. On a more positive note, should the UK Conservative and Labour parties reach a bipartisan deal on BREXIT a likely stronger GBP would boost EUR and reduce economic risks.

-

Trade risks boost USD at the expense of EM/AXJ currencies, especially CNY, which has been rooted to around the 6.70 level for months but has now weakened and broke through a support at 6.75. However, the key support is the 200DMA at 6.86, which we expect to fail if a US-China deal falters or fails. A weaker CNY, arguably as important these days as USD for EM currencies, would pressure down AXJ/EM currencies at a time when many central banks, such as the Bank of Korea, are sounding more ‘dovish’ or acting as the Reserve Bank of India has.

Commodities

-

Brent continued its momentum from March and gained +11.87% before topping off and ending April +7.72%. Brent returned some of its gains as it failed to breach a key technical resistance of $75, thanks to Trump’s tweet and claim that he demanded OPEC to lower their oil prices. Oil is currently held by the 200DMA acting as a support at 69.24. We currently see a few factors in play against oil falling lower, but continue to believe these biases are overshadowed by the massive rate of which US shale oil is being produced.

-

We continue to expect Brent oil will trade in a range of $60-75/brl with upside capped by rapidly expanding US shale oil production and signs that Russia might be unwilling to follow Saudi Arabia’s line on OPEC+ quota discipline as it is wary of losing further market share and a slowing global economy. At the lower end, weaker prices would curtail some US shale output, while OPEC+ would become more sensitive to lower prices relative to higher numbers used to calculate fiscal budgets.

-

Gold ended the month flat, developed extensively in its technicals. Following the strength of USD, Gold had a tumultuous period in April. The next support is found at 1,253 after breaking its support at 1,293. We continue to see dollar strength on the back of higher USD real yields and therefore we expect gold to weaken relatively. The next support for gold can be seen at its 200DMA, 1,253.

-

On technicals, we see a head and shoulders variant of which the neckline, shown in red below (Figure 8), has recently broken. We believe that this trend will now act as a resistance.

Figure 8: Gold prices see a ‘head and shoulders’ Source: Bloomberg

- Gold has been in a downtrend since testing recent multi-year highs at $1,340/Oz but appears to have found support at the $1,270/Oz level and may well be buoyed by trade tensions in next few weeks. One prominent sell-side house forecasts it will be back at $1,340/Oz during Q2CY19 and go through $1,400/Oz in the medium term as USD weakens and UST yields fall. It has been quite clear, of late, Gold prices have closely moved, inversely, to moves in USD and UST yields YTD and we expect this to continue.

Apr 15, 2019 | Articles, Global Markets Update

“Ultimately lower rates are only good to a point because, eventually, the fall in rates is not just about the Fed giving equity investors a “green light” to load up on risk, but also indicates concerns around GDP growth.” `– MORGAN STANLEY

Look through or come off. Financial markets have been surprisingly resilient since the lows at Christmas Eve. Optimism over an early US-China trade deal, the obvious pivot by the Fed to be more ‘dovish’ (FI markets expect a rate cut in ’19 now) relative to its ‘hawkish’ stance last October, and other central banks’ like the ECB and PBoC and China’s more aggressive fiscal reflation, have all helped improve investor sentiment with markets rallying from very oversold conditions at YE18.

Whilst there are undeniably positive drivers, our cautious tactical stance remains as we believe the US-China trade deal will disappoint in leaving considerable post-deal uncertainties with a still material risk that a deal will fail given the wide differences between both parties over post enforcement checks. Underlying corporate earnings are still being downgraded and Q1 results may well disappoint at a time where the S&P 500 has become expensive relative to history whilst other markets are no longer cheap. GDP forecasts continue to be lowered – notably in EU – although China’s GDP outlook has ‘firmed up’.

Political risks are rising in Q2 – notably Brexit agonies, where a ‘no-deal’ is still a distinct possibility, and India, where a likely weak BJP coalition is perhaps the most likely result. Concerns remain around political risks in Turkey, Argentina, South Africa, Brazil, Venezuela, Ukraine and Thailand that could knock-on to EM FX, FI and equities. With strong rallies in equities and JY FI YTD, we believe taking some money off the table makes sense given the potential headwinds and the history of returns in most years since ’09 bar ’17’s exceptional gains. Ultimately, the rally in sovereign bonds YTD, with now around $10tn with negative yields, cannot be reconciled with the rally in riskier assets as the latter implies deflation if not a recession sooner or later.

The main risk to our cautious stance is if investors can use China’s reflation, trade optimism and central banks’ pivot to ‘bridge’ across a weak H1CY19 to an expected recovery in earnings forecast by Q4FY19 and stability in GDP forecasts that would support a further rally in risk assets (and a likely sell-off in USTs). This is not our base case, but we have put in place upside risk management triggers should we be proven wrong.

Recession or not? The inversion of the 3m/10y US yields on 22nd March, the first since ’07, may signal a recession during 2H20 based ib the past albeit this is better in telling us it will happen rather then when (it could be any time from under 12M to well over 3Y). The signal has historically been a reliable predictor of seven of the last nine recessions. There are some very plausible arguments, not least by Mr Dudley (the last New York Fed governor), that this time is different as: quantitative easing by the Fed and other central banks have lowered absolute interest levels to make it technically possible for such an inversion; the Fed is not tightening and financial conditions have eased considerably; there is a breakdown between real interest rates and underlying GDP growth since ’14 as noted by Pictet and; lastly the absence of any obvious ‘bubbles’ in financial assets or the wider economy.

In looking at the components of the US GDP, it is unlikely, given robust consumption underpinned by record low unemployment and accelerating wages (+3.5% YoY in February NFP), we will get a recession in 2020. However, the US economy will slow from Q4CY19 as Federal final spending is set to fall sharply and private sector capital expenditure is expected to ease down, making a ‘shallow’ recession quite feasible. A recession would justify the Fed’s ‘pivot’ and strengthen the FI markets view that the Fed’s next move is to cut rates.

There is a high degree of uncertainty as to what the macro data will bring from deflation and recession to inflation reigniting and GDP numbers surprising to the upside which have binary implications for portfolio construction. Our base case is we avoid a recession this year and next and that exposure to equities remains a better choice than to sovereign bonds. We will need to be nimble and tactically quick to respond to developments which includes a sizable precautionary cash holding to mitigate volatility spikes and to take advantage of them. Strategically we remain convinced we are in a 3.5-year period of low returns and that volatility will rise that argues for portfolio diversification and the use of non-traditional asset classes, as did endowment funds in recent years (Fig 1).

Fig 1: Endowment funds – asset allocation in 2007 vs 2018 Source: Bloomberg, Julius Baer

Equities

-

Despite a rough start earlier in the month, US equities were broadly higher as all three major indices managed a higher close in March. NASDAQ (+2.61% MoM) outperformed as Tech shares rallied, while the Dow Jones Industrial Average (+0.05% MoM) under performed after its biggest index component, Boeing, fell by as much as -17.2% from all-time highs after questions were raised over safety issues relating to the company’s 737 MAX planes. Notably, small caps also under performed, with the Russell 2,000 (-2.27% MoM) logging a decline as concerns over economic growth lingered (Fig 2).

Fig 2: March total returns of the S&P 500, DJIA, Nasdaq and Russell 2000 Source: Bloomberg

-

Technicals show the S&P 500 moved through key resistance levels to within 2% of its all-time high. We believe US equities will struggle to move higher as valuations are now expensive relative to history, and earnings are likely to contract in H1FY19 and we are trimming here.

-

Mueller’s report removes the threat of impeachment ahead of the 2020 elections and helps Trump’s re-election chances, especially if the Democrats were to choose a Socialist candidate.

-

We expect macro data to slow in 2019 as fiscal spending slows sharply in H2CY19 while private capital expenditure weakens, creating headwinds to consumption. Weaker growth would support a higher weighting in ‘growth’ sectors as IT over ‘value’. Hence, we expect Nasdaq to outperform.

Fig 3: Stoxx 600 MoM sector performance Source: Bloomberg

-

European equities were also higher as Stoxx 600 gained 1.69% in March, led by gains in Personal & Household Goods and Food & Beverages. Bank stocks were the worst performers, after Draghi indicated rates would stay on hold for the rest of the year, a move which sent Bund yields into negative territory for the second time in history (the first being in 2016).

-

Brexit remains the overhang for Stoxx 600 and FTSE 100 and sadly, there is no agreed route and it is still a possibility of a no-deal. The next deadline is 12th April and the hope is an agreement by Parliament based on a ‘softer’ Brexit now that May is reaching out to the Labour party leader.

-

Deteriorating macro data YTD in EU could see the bloc’s economy fall into a shallower, technical recession in 2019 and may imply earnings in 2019 could contract relative to the current consensus of +4%.

-

There are political risks outside of Brexit as well. The EU election during late May might see anti-Euro populist parties gain considerable ground (even more so if the UK was to be involved in the vote) that would likely be a source of volatility in EURO and FI, which will eventually lead into Stoxx 600.

-

Shares in Asia also trended higher across the board, with China A-shares (+5.10% MoM) once again outperforming the region. This time, however, India’s Sensex (+7.82% MoM) surged ahead as INR also gained, taking the index to a +10.17% monthly gain on a USD-adjusted basis. For the quarter, A-shares are still significantly higher at +27.03% compared to the Sensex at +7.79% which still under performs the broader MSCI Asia ex-Japan Index which is up 11.21% in USD terms.

Fig 4: USD-adjusted Total Returns across indices in Asia Source: Bloomberg

-

-

Nikkei, on the other hand, fell 0.84% with the Yen mostly unchanged from the start of the month. Japanese equities continue to under perform in Asia, climbing +5.95% this quarter against most other indices which have logged double digit gains. Last weekend, Abe’s coalition also won approval to run a record ¥101.46tn fiscal budget in 2019, with close to ¥2tn set aside for stimulus measure aimed at cushioning the Oct 1 increase in consumption tax

-

AxJ equities are being led higher by Chinese equities and especially A-shares as local retail investors are buying again along with foreign investors, ahead of an increased weighting in MSCI EM next month. We remain overweight Chinese equities and would use any weakness to add to A-shares as we see it hitting 3,600 during 2019 as reflation of the Chinese economy comes about.

Fixed Income

-

The UST yield curve shifted lower over the month, especially in the belly of the curve with the 2Y and 10Y yields inclusive. This caused the 3m/10y spread to invert and led to the steepening of the 5y/30y spread. The Fed’s decision to hold rates in its March FOMC meeting while signalling that it won’t raise rates in ’19 caused the 10Y yield to break its 2.6% support to trade below 2.4% for the first time since December ’17. The 2Y yield also fell below the Fed funds floor of 2.25% after the meeting. However, trade optimism and strong manufacturing PMI data from US and China at the end of the month helped push yields higher. March’s developments saw USTs register their best Q1 result in 3Y as the 10Y yield fell 28bps.

-

European sovereign bond yields fell too as demand increased amid a slowdown in the European economy. The Bunds yield fell and traded below 0% for the first time since ’16. This saw the total sum of negative yielding debt represented in the Bloomberg Barclays Global Aggregate Bond Index to rise to $10.07tn – the highest level since September ’17.

-

Corporate credits saw positive returns across most sectors (Fig 6), but under performed sovereigns as the market turned more risk averse and went up the quality curve. US IG was the best performing sector in the credit space after Asian dollar bonds, returning 2.50% last month. This was mostly supported by falling rates while spreads ended the month mostly unchanged. Strong demand for primary issuances in the IG space also helped lower the borrowing costs for highly rated companies. March saw a 28.57% increase in primary issuances as companies issued $131.28bn worth of debt. IG funds also saw the largest fund inflows in March relative to other sectors. IG funds attracted $13.17bn worth of funds in the month.

Fig 5: Fixed Income sector returns in March ’19 and 19Q1 Source: Bloomberg

-

The key question is whether the Fed’s ‘pivot’, not least in what markets perceived as a ‘dovish’ March FOMC meeting, will prove to be the inflection point in this hiking cycle or, as we believe, a pause. Our view is that the markets have mistaken Powell’s comments to be purely about pausing when, in fact, he explicitly noted that the Fed was data-dependent. We see US macro data as being sufficiently strong to allow the Fed to hike one more time – probably in December 2019, whereas we do see EU data weakness being supportive of the ECB’s recent caution and for lower yields.

-

Whilst we have long failed to find value in higher quality FI (sovereign and IG), even our preferred weightings in US HY FI and Asian HY FI have seen sufficient spread compression YTD to no longer offer much price upside although we would remain invested to ‘clip’ still decent coupons but warn we could see short-term volatility.

-

Tactically, we remain overweight in short-duration paper – be it high quality or HY – as the yield is similar to longer duration paper without the same level of interest rate or default risks.

FX

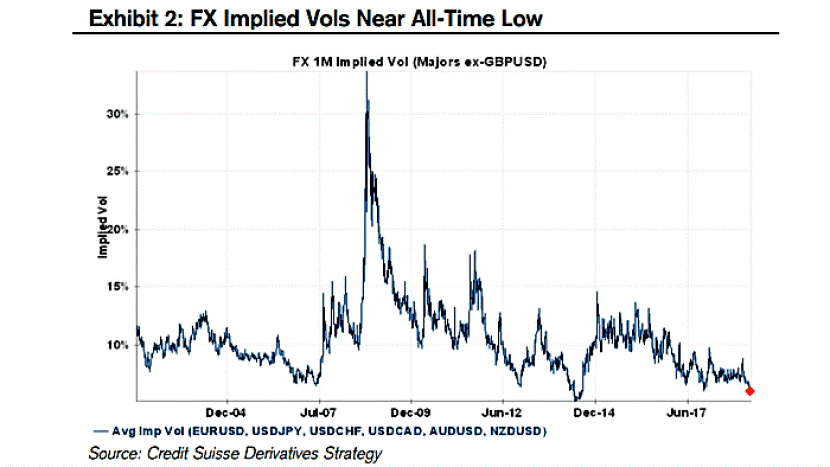

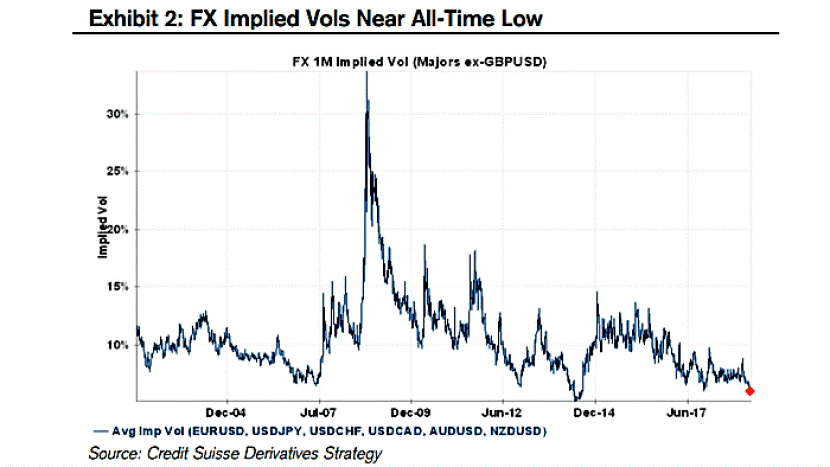

Fig 6: FX implied volatility near all-time low Source: Credit Suisse Derivatives Strategy

-

Volatility in the G7 pairs, bar GBP, has dipped since the start of 2019 as FX markets remain in uncertainty due to key events such as Sino-US trade development and Brexit (Fig 6). EMFX volatility picked up in March, mainly due to BRL, TRY and ZAR experiencing large movements. (Fig 7).

Fig 7: EM FX volatility vs. G7 FX volalitlity Source: Bloomberg

-

The Fed’s dot plot implies that interest rates will remain on hold for the remainder of this year and only improve by +25bps in 2020 and inflation unexpected eased in February. This clarity for the USD has finally come through as markets are no longer pulled by “certainty” (positive market data in Jan/Feb) and “uncertainty” (a “patient” Fed in Jan/Feb). Powell noted that interest rates will remain on hold for “some time”.

-

The Turkish Lira experienced another bout of volatility since Aug 2018. The jump happened overnight and TRY fell 7.50% to 5.84, past a significant key support at 5.50. The Turkish government has reported its suspicion of large foreign banks shorting the Lira. Overnight rates increased to 1300% to prevent shorting. Emergency interest rate measurements taken by the Turkish government failed to suppress TRY weakness.

-

DXY is edging up again towards a key resistance at 97.50 and USD yields bottomed out and it remains, on a relative basis, the best DM economy and that is constructive for the USD. We remain, thus, USD bulls until it is clearer its structural risks (rising fiscal deficit and potential overvaluation) become obstacles.

-

The outlook for GBP, BRL, TRY ZAR and the Argentine peso depends on political developments. An agreed cross-party ‘soft’ Brexit deal would boost GBP towards 1.40 but a no-deal departure on 12th April could sink it back to 1.20. EUR, to a greater extent, will be linked to GBP, but the EU-wide elections could also be a downside risk as it was in ’14.

Commodities

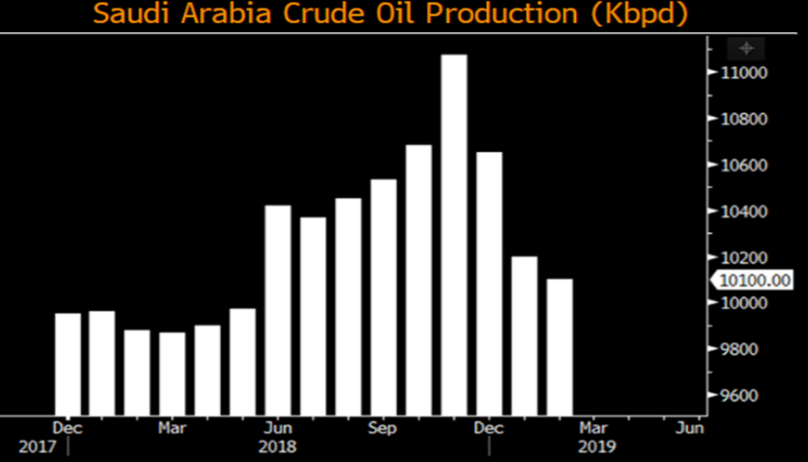

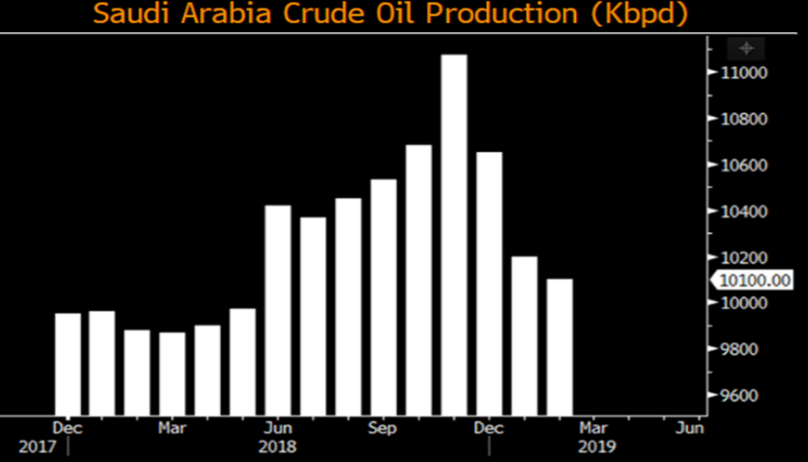

Fig 8: Saudi leads OPEC+ cuts to production Source: Bloomberg

-

Brent crude saw a strong quarter, rising 27.12% YTD and 3.57% in March as OPEC+ cuts to oil production continued. The cartel cut a further 295K/bpd in March, and is believed to continue its commitments to cutting supply and re-balancing the market.

-

Volatile production from countries like Egypt added to supply this month, but we believe that the remainder of OPEC+ countries will eventually catch up and limit their supplies, and this effect should outweigh any of the headwinds.

-

Gold closed mostly flat this month, unable to move past its US$1,352/Oz high in February. This was understandable given the increased risk-on sentiment reflected by the climb in equity markets. This movement in March formed the right shoulder of a Head and Shoulders pattern which started in January.

-

The oil price is being pulled around by OPEC’s (notably Saudi Arabia) supply discipline and regulatory developments on bunker oil relative to rapidly increasing US shale oil production and a slowing global economy impacting demand. In the shorter term, we see the Brent oil price capped around $70/brl but the longer term could see oil prices test $90/brl by 2021 as the effects of the huge 50% fall in capital expenditure since H2CY14 impacts production. Given this, we are trimming our energy exposure.

-

Industrial metals are benefiting from optimism around China’s ability to reflate the economy and from a series of supply disruption that have boosted copper and iron ore at a time the mining giants have proven to be disciplined in capacity expansion, and that could lead to prices moving higher from here in 2019.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Apr 12, 2019 | Articles, Australian Budget Update

The 2019 Australian Federal Budget was handed down by Treasurer Josh Frydenberg on Tuesday, 2nd April announcing the Federal Budget will be back in the black for the first time in twelve years, with a budget surplus of A$7.1 billion dollars forecast for 2019/2020.

Budget Headlines

-

The 2019 Budget shows that tax will be a key topic of discussion in the upcoming election.

-

Forecast surplus of A$7.1 billion in 2019-20 and A$45 billion over the next 4 years.

-

Government introduced an ‘Enhanced’ personal income tax cuts for low and middle-income earners in 2019 tax returns. A$158 billion of personal income tax cuts are promised over a decade.

-

A boost to the instant asset write-off threshold for small to medium enterprises to A$30,000 announced on Budget night.

Below is an infographic from PwC highlighting the key announcements from the Federal Budget.

Fig 1: Key announcements from federal budget Source: Budget.gov.au

What does the budget mean for Australian Expats?

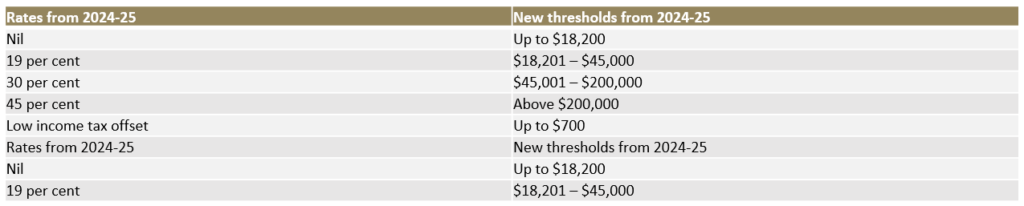

Personal Income Tax Cuts – Australian residents

The Government is reducing tax for low and middle income earners of up to A$1,080 for single earners or up to A$2,160 for dual income families for the 2018/2019 to 2021/22 income years. Taxpayers will be able to access the offset after they lodge their end of year tax returns from 1 July 2019.

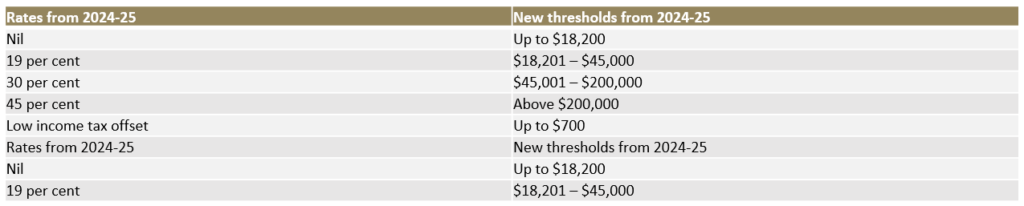

From 2022/2023, the Government will increase the top threshold of the 19 per cent tax bracket from A$41,000 to A$45,000 and the low income tax offset from A$645 to A$700.

From 1 July 2024, the Government is also increasing tax thresholds further and reducing the 32.5 per cent tax rate to 30 per cent.

By 2024, under the proposed changes there will only be three tax brackets: 19 per cent, 30 per cent and 45 per cent.

It’s important to note these new tax rates only applies to Australian residents and no changes has been made to the Non-resident tax rate. For current Non-resident tax rates please click here

Summary of changes to rates and thresholds – Australian residents

Superannuation changes

From 1 July 2020 the Government will amend the superannuation contribution rules to allow people aged 65 and 66 to make voluntary contributions to superannuation without meeting the work tests.

People age under 67 at any time during a financial year will be able to trigger the non-concessional bring-forward rule (e.g. allowing individual to contribute three years of non-concessional contributions up to A$300,000 in single year). Previously this rule only applied to people age under 65.

Under the proposed changes, the age for spouse contributions has increased from 69 to 74, which allows individuals to make contributions on behalf of their spouse for a longer period. In addition, where the receiving spouse is age 65 or 66 they no longer need to meet a work test.

Whilst the superannuation changes may not apply to all Australian expats, it is however important to plan for your super in advance before returning to Australia to take advantage of the contribution limits available and ensuring a successful transition to retirement in Australia.

Funding ATO Tax Avoidance Taskforce

The Government will provide A$1.0 billion over four years from 2019/20, to the Australian Taxation Office (ATO) to extend and expand the operation of the Tax Avoidance Taskforce focused on large corporates, multinationals and high wealth individuals.

The measure is estimated to increase tax collections by $4.6 billion resulting in a net gain to the budget of $3.6 billion over the forward estimates period.

The Tax Avoidance Taskforce undertakes compliance activities targeting multinationals, large public and private groups, trusts and high wealth individuals. This funding is expected to result in further increases in ATO examination activity.

Effective from 1 January 2020, the list of Exchange of Information countries will be expanded to add the following countries:

- Curacao

- Lebanon

- Nauru

- Pakistan

- Panama

- Peru

- Qatar

- UAE

As a result, distributions from Managed Investment Trusts (MITs) to these countries that are currently subject to the 30% withholding tax rate may qualify for the lower 15% withholding tax.

Summary

The 2019 Federal Budget from the Coalition delivered a strong focus on building a stronger economy and securing a better future for all Australians. This comes through lower income taxes, incentives for small to medium business and increased infrastructure spend.

It’s important to note these proposed changes have not yet been legislated until the current Coalition government gets re-elected. It’s also important to be aware of the opposition’s response to these changes and their respective policies. These policies will become clearer as the federal election gets closer.

Whether you are an Australian resident or expat living overseas, it’s important to understand how the budget may impact your personal circumstances.

For a copy of 2019/2020 Budget, click here

CONTACT

For a confidential discussion on the Australian budget and planning matters, please contact Jeff Hiew

Mar 18, 2019 | Articles, Global Markets Update

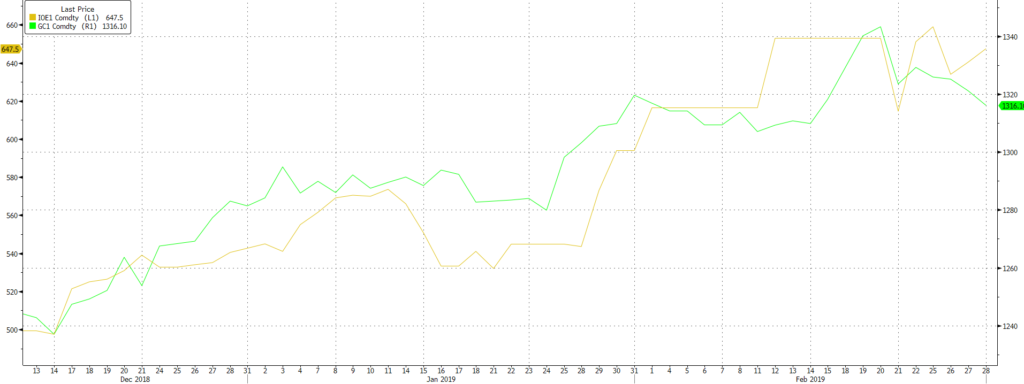

The rally for equities continues after the best January in over 30 years, defying the gloomy consensus seen at the end of 2018 as the S&P 500 (+ 3.0%), NASDAQ (+3.4%) and Dow (+3.7%) gained MoM alongside other major markets which were also up by 2-3%. The exceptions were UK’s FTSE 100 (+1.5%) on a stronger GBP, and a storming move up of 13.8% in China A-shares, including a one-day jump of 5.6% which happened just last week. The week was also the best gain for the index in over four years, as domestic investors’ ‘mojo’ started to reappear (see more below) following last year’s bear market. Stoxx surged 3.9% – in part from very oversold levels – but also helped by a weaker EUR and reduced trade war fears. The S&P 500 beat lowered earnings consensus forecasts for 4Q18 by over 3% to record 13% earnings growth YoY, but elsewhere results were more mixed – Some markets in Asia ex-Japan such as Singapore and Malaysia, instead suffered meaningful earnings contractions. Nikkei’s 3% rise was supported by record share buybacks in corporates’ guidance post-results.

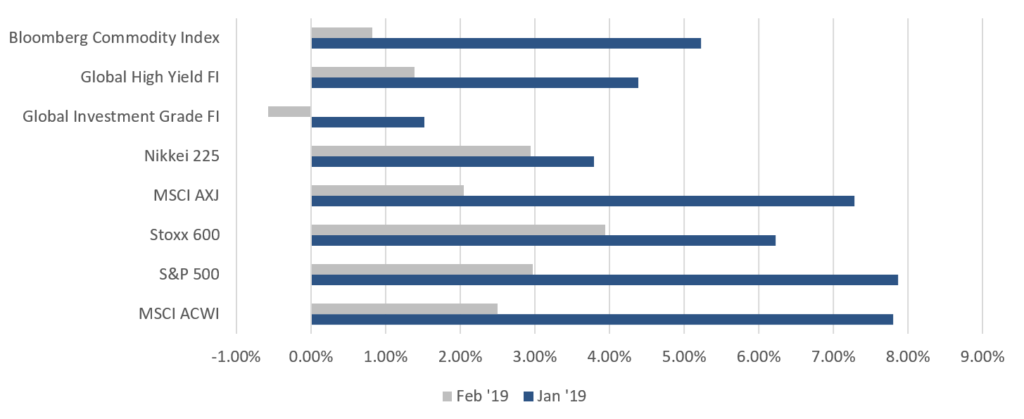

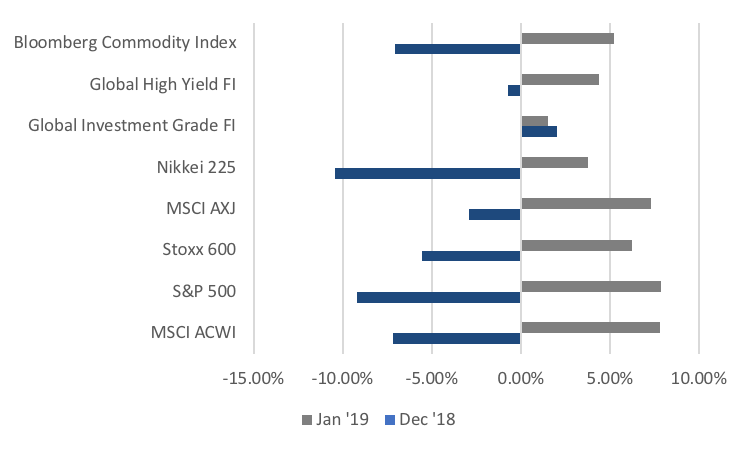

Fig 1: Risk asset performance in Dec ’18 vs Jan ’19 Source: Bloomberg

We are increasingly positive on Chinese shares, whether offshore or A-shares. We like the attractive valuations, proactive policy action, fiscal expansion, PBoC’s easing and improving earnings forecasts in contrast to other large equity markets which are mostly experiencing weaker earnings forecasts, slowing GDP and more limited fiscal expansion. Our base case remains a Sino-US trade deal will occur – most probably in Q2 – and this should underpin CNY below 7.00 if not push it to strengthen further to 6.50 by YE19.

Fig 2: Normalized 10Y chart of SHASHR against the HSI Source: Bloomberg

We are becoming more cautious overall after equity markets and other higher risk assets (such as lower quality HY FI), have rallied strongly from Xmas eve lows. This has taken S&P 500 valuations back into expensive territory, and most other equity regions to fair value from inexpensive – bar PRC equities that remain attractive. Likewise, the rally in credit, with spreads tightening across the board but more so for HY (CCC’s especially) and EM FI, has moved most areas of FI back to fair value whilst sovereign DM FI continue to offer unappealing risk-reward ratios. We see the huge increase in supply of US treasury issuances driving yields higher, with 10Y UST yields testing 3% during 2019. We think that the upside from a likely Sino-US trade deal is mostly priced-in, whereas the risks from an equally likely US imposition of tariffs on global auto imports – at some point in Q2 – is being ignored. We believe that the adage “it is better to travel than arrive”, will apply to the Sino-US trade deal as there is a high chance it will be a partial deal, leaving scope for plenty of future uncertainties as we are only at the cusp of a wider strategic confrontation between the two superpowers.

On a fundamental basis, traditional drivers of risk assets (growth in earnings and GDP) continue to be downgraded (the exception being upgrades to PRC earnings forecasts), and we doubt these will stabilise until 2H19 with 1Q19 set to be quite disappointing. Other positives are also increasingly discounted by markets, namely reduced fears over a Brexit ‘no deal’ outcome, pension reforms in Brazil and a more ‘dovish’ Fed. Admittedly, not all is gloomy as positioning remains light on several indicators, including above average cash levels according to BAML’s PMS survey of the largest global allocators.

We are also seeing offsetting policy action by some governments, notably PRC, increasing fiscal spending, and some central banks turning more ‘dovish’, including the Fed and PBOC, with ECB widely expected to turn more ‘dovish’ too. As a consequence, we have been raising cash and cash equivalents across portfolios and will continue to do so should markets rally further.

Equities

- Trump declared a national emergency over the ‘wall’ in a bid to allay his support base that House Democrats are challenging. Last week we also witnessed the Trump-Kim summit which ended abruptly on an impasse, resulting in both parties going home empty handed without a deal.

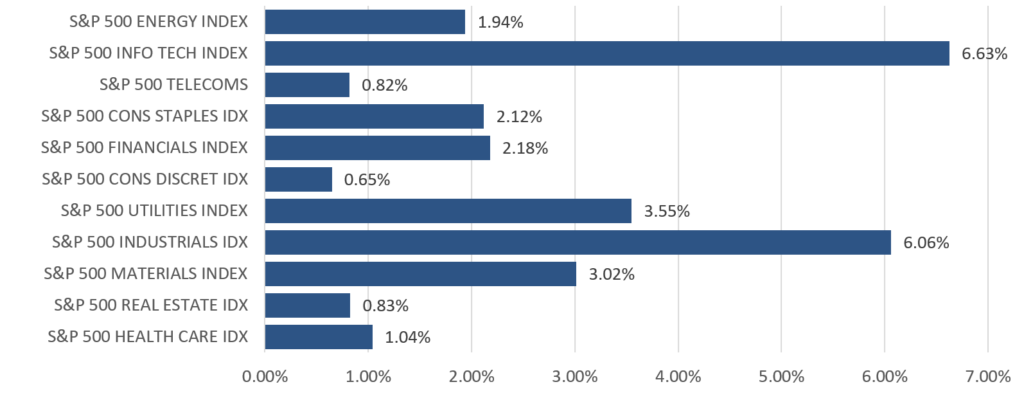

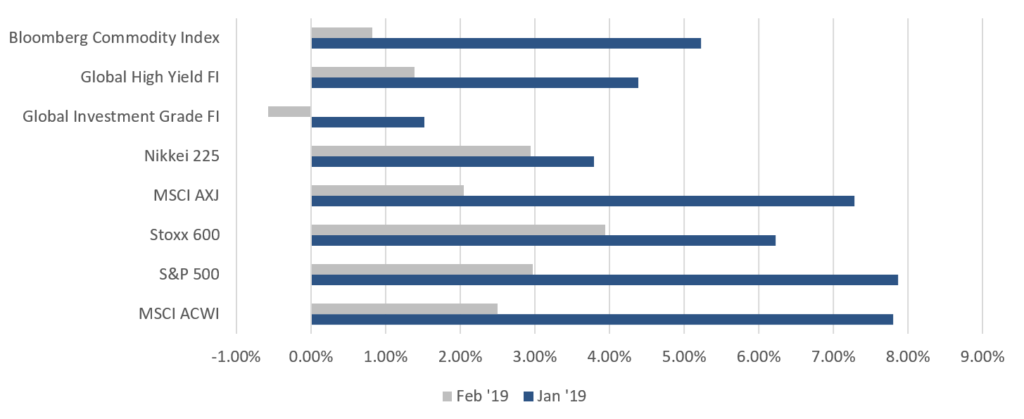

- US equities continued up from Jan’s recovery, with all three benchmark indices ending the month firmly positive as IT (+6.63%) and Industrials (+6.06%) led gains in the S&P 500 (+2.97%), while the Dow and Nasdaq were up 3.67% and 3.44% respectively. Markets were also somewhat sated after Powell reiterated the FOMC’s patient approach and sensitivity to capital markets, but also that the Fed would hold a much larger balance sheet than it did pre-crisis.

Fig 3: MoM moves across S&P 500 sectors Source: Bloomberg

- S&P 500 has reported earnings for 4Q18 – 72% of companies have beat estimates to an aggregate earnings surprise of 3.59%, while the aggregate growth rate of earnings came in at +13.07%, in-line with the estimate of +12.10% at the end of FY18. Unsurprisingly, elevated oil prices helped the Energy sector to the highest earnings growth of all, at +93.5%.

- For 1Q19, the aggregate analyst prediction is a -3.2% decline in earnings. MS has warned that FY19 could see a possible earnings contraction after a string of forecast downgrades, trimming their own estimates for FY19 EPS growth to just 1% from an earlier 4.3%. The house maintains their S&P 500 price target of 2,750 at YE19. Consensus FY19 EPS (Earnings Per Share) growth is estimated at +5%, but there remains a risk of an overall contraction although analysts see a recovery from weaker H1 earnings by Q4 coming from an easier base of comparison.

- European equities saw broad-based gains, with the Stoxx 600 climbing 3.94% in the month. Materials (+7.26%), Chemicals (+6.07%) and Insurance (+6.19%) led gains across sectors, while defensives like Utilities (+0.27%) and Telecommunications (-0.01%) were visibly weaker. Real Estate (-1.76%) was the only sector to see a decline.

- Stoxx is being torn by upside from relatively cheap valuations against the S&P 500, and its far worse economic performance that could result in an earnings contraction. EU SMEs are more vulnerable to a weaker economy, but could rally in the short-term if ECB becomes more supportive. EU will be especially impacted if US imposes auto tariffs that would hit the large EU auto OEMs hard. Our base case is Trump will impose tariffs, if more to appease his support base, but would lift them quickly to avoid damaging the US economy – a bit akin to NAFTA.

- Shares in Asia trended higher on optimism around trade, as rhetoric (mostly from the US) and sentiment on a near-term trade deal grew increasingly positive particularly toward month-end. The MSCI Asia ex-Japan’s +2.05% MoM gain was completely overshadowed by the run up in China A-shares (+13.91% MoM), which have surged over 20% from early Jan lows into a technical bull market.

Fig 4: SHASHR outperformance against other indices in Asia Source: Bloomberg

- The Nikkei also managed to climb 2.94% last month, but on the back of a weaker JPY which saw the index only up +0.62% MoM in USD-adjusted terms. GDP growth in 4Q18 came in at 1.4%, with IMF forecasts pointing to a further slowing of economic momentum in ’19. Corporate profitability has, however, stayed near record levels, and risks around deflation have decreased significantly.

- Over the course of this month, the delay of trade tariffs were confirmed, alongside subsequent reports which pointed toward substantial progress in the ongoing negotiations with March 27th now being suggested as the tentative date for Trump and Xi to sign off on a deal. However, the US’ point negotiator Lighthizer did temper market expectations later in the month, commenting that ‘much still needs to be done’ before an agreement could be reached.

- We see a lot of good news discounted by gains in Asia ex-Japan and EM equities YTD, with valuations of MSCI Asia ex-Japan back at historical levels and earnings forecasts still coming down. Given this, there is a stronger case to turn more defensive and move tactically into cash. An exception – see above – might be A-shares, as opposed to a number of H/HK shares looking more vulnerable now.

Fixed-Income

- US Treasury yields traded within a tight range for most of February before better-than-expected 4Q18 GDP numbers led UST 2Y yields to end 5.65bps higher at 2.51%, and UST 10Y yields to end 8.67bps higher at 2.72%. The yield curve saw a parallel shift downwards across the 2Y to 10Y period, with the 2Y10Y spread increasing by only 3bps over the month. Technically, UST 10Y yields found support at 2.63%, having failed to break below the level despite testing it four times.

- European sovereign bonds were mixed. Bund yields saw weakness throughout the month following multiple weak economic data releases, hitting a low of 0.08% before ending the month at 0.18%. Strong demand for new Italian and French debt issuances followed a series of strong European sovereign bond sales this year.

- PIMCO and CS both expect UST yields to rise in order to absorb the massive extra issuance needed to fund the fiscal deficit, with both expecting UST 10Y yields to reach 3% in 2H19. Foreign buying is impacted by a high cost of hedging USD, effectively eliminating most of the nominal yield pick-up available.

- The Fed may have erred by switching from being too ‘hawkish’ in Oct last year to being too ‘dovish’ following the Q4 swoon in capital markets. With the US economy seemingly still in rude good health and markets having recovered, there lies a growing possibility that the Fed might surprise complacent FI markets by reasserting its 2 rate hikes in the ‘dot plot’ guidance, even if technical factors instead support an end to balance sheet reduction.

- There is polarisation around whether to move up the credit curve to avoid a coming credit crisis. To some extent, this is linked to recession risks over the next 12-18 months. Those who doubt this would prefer the risk-reward in HY and EM FI. What is worth noting, is that PIMCO thinks the rating agencies are far too optimistic with their ratings, plus we know the majority of issuances are covenant-lite, and that reduces recovery rates.

FX

- FX volatility has fallen significantly, with the DXY barely moving and most other currencies stuck in their respective trading ranges. GBP, AUD and JPY were the exceptions.

- USD – January’s dip was compensated by gains in a risk-on environment as political tensions eased up. Overall, there are mixed sentiments for the dollar as investors juggled between Powell’s dovishness and positive US economic data.

- JPY weakened sharply against the USD last month to test, and weaken through, key support at 111.50, as the BOJ reiterated its accommodative monetary policy stance, macro data disappointed and concerns grew about global auto tariffs which Japan would be significantly impacted by.

- The EUR touched a monthly low of 1.123 on fears of auto tariffs. ECB and others, as IMF, have revised growth projections lower to 1.7% for 2019. The EUR has shifted its trading range from 1.13-1.18 in to 1.125-1.15, weighed down by potential snap elections in Italy as well as Spain. Brexit also weighed on the EUR.

Fig 5: GBP moves on Brexit Source: Bloomberg

- So far this year, Brexit has seen the GBP trade in a wide range of 1.27 to 1.33. It started the month at 1.310, traded to a low of 1.277, but ended the month at 1.326, on increased hopes a ‘no-deal’ option will be rejected by Parliament. It recovered above its 200DMA at 1.30 after falling below this level earlier in the month. Markets are currently pricing in a potential second referendum, which will add strength to GBP. 1.33 remains a key resistance level.

COMMODITIES

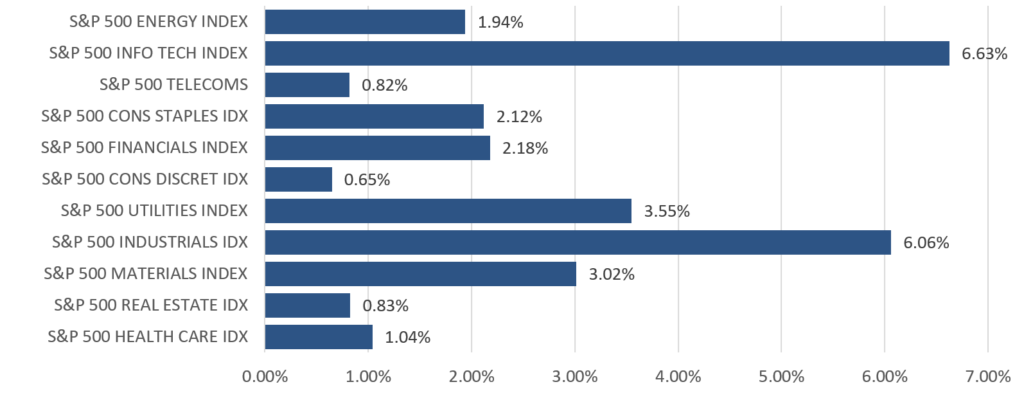

- Brent crude gained 6.69% through the month, breaking through its key resistance at US$64/bbl on continued commitment to production cuts from OPEC+. Prices were also supported by reports that the group could move toward a more formal agreement, which could see the cartel control 66% of the global supply of oil and over 90% of spare capacity.

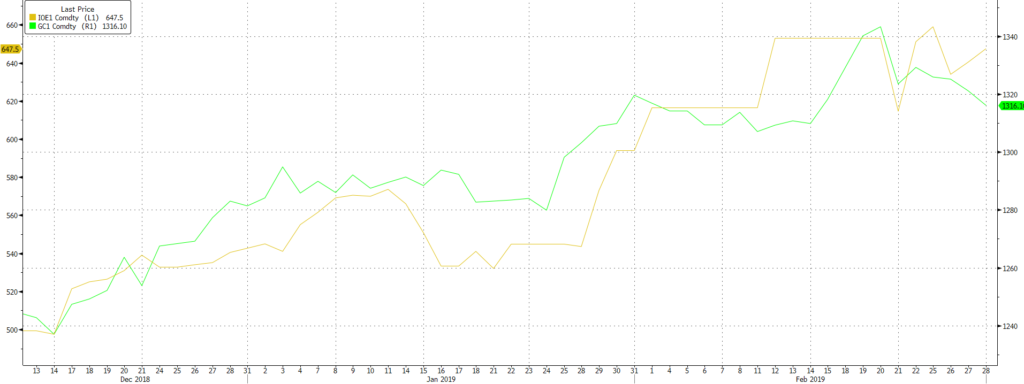

Fig 6: Gold (green line) tapers off, while Iron Ore (yellow) hits all-time high Source: Bloomberg

- Gold broke out earlier this month to test a high of US$1,346.71 /Oz, but failed to test the key resistance level just above $1,360/Oz. It then fell sharply thereafter on a combination of profit-taking and rising UST yields, alongside a stronger dollar which weighed on the precious metal. It broke through support levels at $1,320 in late-Feb, and $1,300 in early March to where it is currently testing the next key support at $1,280.

- Iron ore hit its all-time-high after the Vale mine disaster abruptly tightened global supply, whilst PRC’s implicit ban on Australian coal imports created movements in thermal and coking coal and again, highlighted the dangers of being a major supplier to PRC as the ban was linked to Australia’s decision to exclude Huawei as a supplier to 5G telephone systems on national security grounds.

- We remain constructive on oil as we believe there are supply-side restrictions that will underpin prices above $60/brl for Brent. The super OPEC+ cartel will have much greater pricing control than OPEC did, and thus will more easily be able to counter rising supply from US shale oil production to retain their status as a price leader. US shale oil producers will remain a force – just this week, both Exxon and Chevon said that they would triple oil production by ’23 at their respective Permian basin fields. It is material as Exxon expects to produce over 1m bpd by then, with Chevron not too far behind.

- Another support for oil prices is the continued capex discipline of the large, integrated oil companies, as spending remains 40% below the peak in 2014, with estimates that it will rise just 5% this year. If this continues, there is a genuine risk of a supply crunch by as early as next year that could see oil prices jump to over US$90/bbl.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Feb 18, 2019 | Articles, Global Markets Update

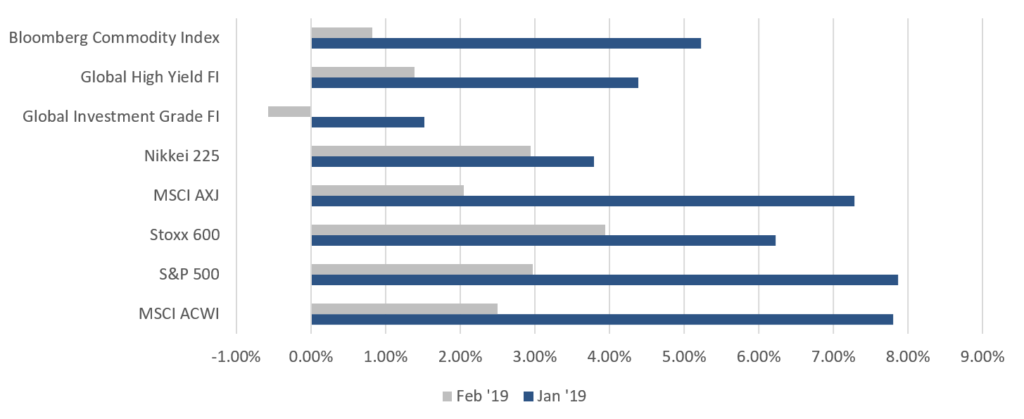

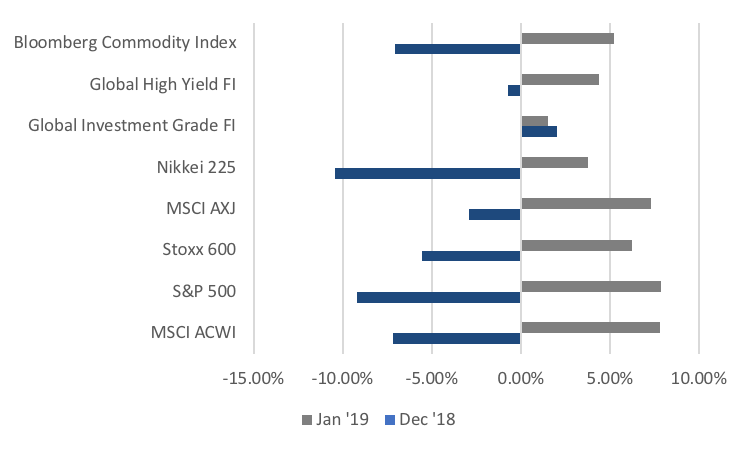

Risk assets rebounded strongly in January after a horrific December (Fig 1). The MSCI ACWI gained 7.80% in January, its largest gain since October 2011. This came after December’s fall of -7.17%, the second-largest fall since May 2012. A more significant comparison can be seen in the US, with the S&P 500 seeing its best January since 1987 after its worst December since 1931. Similarly, global investment grade (IG) fixed-income (FI) gained 1.52% in January while global high yield (HY) FI gained 4.39% following December’s 2.52% and -0.75% respectively. The VIX index has also been registering higher ‘lows’ in January, adding to signs that volatility is indeed returning.

Fig 1: Risk asset performance in Dec ‘18 vs Jan ‘19 Source: Bloomberg

Fig 1: Risk asset performance in Dec ‘18 vs Jan ‘19 Source: Bloomberg

Risk assets were supported on two fronts in January, with the first being optimism around the US-China trade situation. The first major round of trade talks since the Trump-Xi truce took place at the start of the month and ended on an optimistic note. Our base case remains that a narrow trade deal will likely be done, though the US is after a wider deal that addresses structural issues. A dovish Fed also provided support to risk assets, alongside a weaker dollar for the most part of January. Within FX, Asia ex-Japan (AXJ) pairs were the main beneficiaries of the USD weakness as they rebounded from their 2018 lows. There was also volatility around the GBP as it followed Brexit headlines.

Tactically, we remain cautious as fundamentals continue to deteriorate, bar a robust US economy (January’s ISMs and NFP numbers imply Q1 GDP growth of c. 3%), as we continue to see global GDP numbers being downgraded to c. 4-5% growth, from +10% at end of Q3FY18. Historically, equities struggle in the face of deterioration in EPS and GDP forecasts so the billion-dollar question is – what are markets discounting? If the December fall was overdone and predicated on a recession and EPS contraction, then one wonders at what point will this rally run out of steam (barring a US-China trade deal later this month), given that investors have repositioned quite aggressively since Christmas Eve, which has reduced this underpin.

Other than trade, the only other clear positive is that almost no one is positive, with a majority remaining uncertain and fearful. It continues the tradition of this being one of the most hated bull markets and economic expansions of all time, just as these are one of the two longest such periods. Equity bull markets and economic expansions do not die of old age and it is hard to see signs of the euphoria typical of the final stages of a bull market.

Another factor we strongly think is being ignored by markets, is the continued evidence of a strong pick-up in fiscal spending that appears to be globally synchronised. No doubt this is helped by the fact that we are in election years in parts of AXJ, coming into European Union (EU) elections in May, and are at the start of the US election year campaigning. We expect the Federal fiscal boost to continue well into 3Q19, with a large chunk of tax rebates for households being mailed out in the next few months to help consumption.

We would note (rather cynically) that based on history, the prospect of additional, and thus higher, Federal spending into elections is quite high, notwithstanding a consensus view that partisan politics will stymie extra spending in an Infrastructure Bill. Markets rarely seem to understand that fiscal spending tends to be dynamic and we have evidence that fiscal spending is picking up globally, be it from the EU (Germany, Italy and France are all set to spend substantially more as a percentage of GDP as most likely will UK), China, India (we are seeing Modi’s Bharatiya Janata Party government boosting handouts to farmers) or Japan (the government is expected to boost spending, including a package to offset the GST-hike set for October this year). Should a US-China trade deal materialise, these drivers, as they materialise in better GDP numbers by 2H19, could power the next leg of the rally in risk assets in the medium-term but stoke inflation in the long-term.

Equities

- The S&P 500 (+7.87%) saw a broad-based rebound from December’s decline, although gains varied as Energy and Industrials powered ahead, leaving defensives like Utilities trailing behind (Fig 2). The Technology sector was slightly mixed after heavyweights such as Facebook guided for lower growth, weighing on sentiment across the sector. However, others such as IBM rallied after posting strong earnings beats and better-than-expected guidance for FY19. The Dow Jones (+7.17%) and Nasdaq (+9.74%) also experienced a similar rally in January.

Fig 2: Defensive sectors lagged in the S&P 500 Source: Bloomberg

Fig 2: Defensive sectors lagged in the S&P 500 Source: Bloomberg

- The STOXX 600 (+6.23%) also joined the rebound in global equities, with Telecommunications being the only sector to see a decline. This came after concerns over alleged spying by Huawei led to companies pulling out of ongoing 5G infrastructure developments (on top of pressure from the US), but also as investors grew weary of further delays and potentially higher costs in alternative providers. Within the index, just over 30% of companies have reported earnings, with 54.63% reporting an aggregate beat of +8.85%, and an aggregate earnings growth of +4.19%. On the other hand, over 44% of these companies saw earnings surprise to the downside.

- Nikkei (+3.79%, or +5.31% in USD adjusted terms) had a relatively poor performance against the broader MSCI AXJ (+7.79%). While the Shanghai Composite Index (+3.65%, or +6.40% in USD adjusted terms) lagged behind on continued USDCNY strength, the recovery in sentiment on Chinese equities was evident in the Hang Seng Index (+9.33%) which led gains across Asia.

- It is important to highlight that USD rates, relative to AXJ, are a good indicator in determining returns for equities in this region. Credit Suisse released an analysis some months back that showed AXJ equities outperforming their US counterparts by over 5% when the USD weakened by 5% or more, and vice versa when the USD strengthened. JP Morgan (JPM) backs this up in a research paper, showing that AXJ outperformed 100% of the time and on average by around 20%. Interestingly, many FX strategists are now predicting the USD to weaken significantly against currencies in AXJ, with the USD having been on a downward trajectory since October.

- A weaker USD coupled with far more stability in US equity markets (that have moved away from trade and bear market concerns) provide a scenario which is supportive for equities in AXJ. On top, EPS downgrades in this region over the past three months came in at -3%, which was less than the -5% decline in estimates for the S&P 500. The tail risk remains, however, that this could change rapidly, and that this market requires a close eye and strict risk controls.

- Looking specifically at China, it appears that markets seem to underestimate the degree of liquidity easing, tax cuts and reflation, in the same way that markets had arguably overestimated Trump’s one-off tax reforms in the 18H1. In our view, these are likely to cushion, if not support Chinese equities, and are drivers that other markets seem to be lacking.

- It was a somewhat eventful month for the US, after we saw resolution to the longest-running US government shutdown, but also as some economists continued to trim US GDP growth estimates for 18Q4 and 19Q1. Powell himself raised concerns over the potential impact of the shutdown, and some estimate that the shutdown may have trimmed 40bps off 19Q1 GDP growth alone.

- It is likely that markets continue to underestimate US political risks, with the recent government shutdown potentially a foreshadowing of an even larger tussle when government funding runs out in September. Additionally, developments around the Mueller investigation also point to a genuine risk that he may indeed have a ‘smoking gun’ tying Trump to the Russians, which could prompt the latter to shut down the investigation entirely. Either scenario could potentially trigger a constitutional crisis. The greater concern for markets, is Trump’s unpredictability which ratchets up as he comes under pressure, particularly if it relates to legal or constitutional pressures.

- Evidently, these looming risks are sufficiently negative to have significant implications for the US market, more so if we see both intensify at the same time which is not at all unlikely given Trump’s history. We need to remain cautious around 19H1 beyond these two risks as they exacerbate the broader US/global GDP slowdown, weaker EPS growth, and uncertainty over whether Powell made a mistake in tightening too far. Our base case remains that these fears are exaggerated and will likely be reduced over time as hard data provides greater clarity over direction and quantum.

- Given this, we are cautiously optimistic on a positive outcome on trade in the near term. Trump continues to face pressure from blame over the recent shutdown, weakness in the US equity markets have investors questioning the US growth outlook, while Xi is likewise tackling the impact of multiple factors which have led to China’s slowing economy. Both have incentive to ensure that some degree of progress around trade negotiations are secured at least in the near-term.

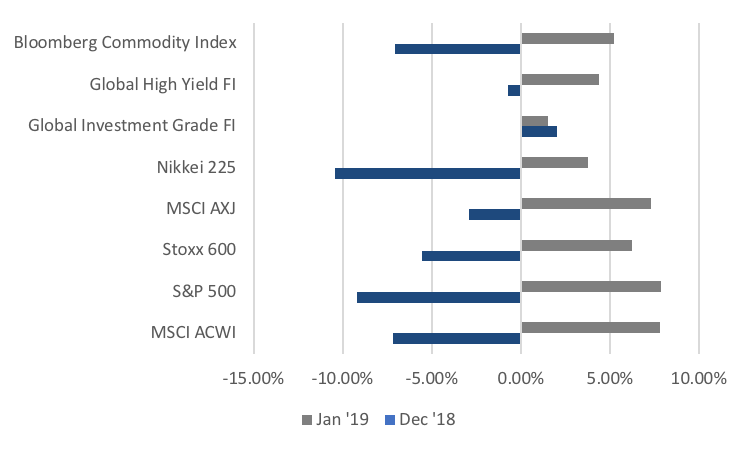

Fixed-Income

- Sovereign debt was relatively flat in January as the market turned mostly risk-on. US Treasury (UST) yields rose sharply at the start of the month as investors turned risk-on following a blowout in December’s NFP numbers and rotated out of the safer government debt. The UST yield curve saw a parallel shift downwards, with greater falls in yields in the 5Y to 10Y period (Fig 3), following a dovish announcement by the Fed that led markets to think that rate hikes might be on hold. Bunds sold off early in January, along with USTs, but yields trended lower through the month as weaker economic data weighed on sentiments.

Fig 3: Yield curve shifts lower in January Source: Bloomberg

Fig 3: Yield curve shifts lower in January Source: Bloomberg

- Credit also saw a positive return across all sectors, as spreads eased lower after reaching 2016 highs in December. The risk-on mood saw US HY gain the most, finding support from fund inflows, steady US economic data, rising oil prices and a dovish Fed. The Bloomberg Barclays US HY index gained 4.52%, its largest January return since 2009 (Fig 4), with CCC-rated bonds jumping 5.29% while BB yields fell to a 4M low of 5.32%.

Fig 4: Junk bond comeback Source: Bloomberg

Fig 4: Junk bond comeback Source: Bloomberg

- Bloomberg data also showed EM debt issuance reaching $172bn MTD. This is more than any January on record as borrowers took advantage of the strong demand from the turn in sentiment toward risky assets in January.

- We think Powell’s dovish comments might not be entirely a good thing. Powell seems to have overcompensated for 4Q18, and is simply giving the markets what they want to hear with no clarity. The Fed’s pandering to markets led several sell-side banks like GS, JPM and BofAML to think that the UST 10Y yield might have peaked for this cycle, causing them to cut their year-end projections.

- However, we think the US economy remains robust, as evidenced by the strong January NFP and ISM manufacturing PMI numbers. This, coupled with the US Treasury’s expected issuance of $365bn in debt in 1Q19 ($8bn more than its previous estimate) to finance its widening deficit, should provide upside pressure for UST yields.

- We maintain our conviction in shorter-duration debt given its defensiveness against interest rate risk. We continue to like HY debt as we believe there is still room for growth, and fundamentals for the sector remain strong. Analysts have also expressed a similar view, with the likes of Wells Fargo and Barclays upgrading their annual forecasts of US HY returns to 9.9% (from 6%) and 6.5%-7.5% (from 3.5%-4.5%) respectively.

FX

- A dovish Powell caused weakness in USD during the start of January, which has been reflected in the recovery of AXJ currencies after last year’s decline. The DXY tested 95.300 twice – once during the first week of January and the other on 30th This level is just above the 200DMA found at 95.371. We remain moderate dollar bulls on the basis that the US economy remains strong and positive data will lead the Fed to resume raising rates.

- JPY strengthened to 108 in the first half of January on dollar weakness, which is also a resistance level, ignoring the flash crash to 104.96 early January which resulted from trading on thin liquidity. Unsurprisingly, BOJ left rates unchanged and lowered its near-term GDP forecasts. This, along with relatively stronger data out of the US are factors that could lead the JPY lower to 110.

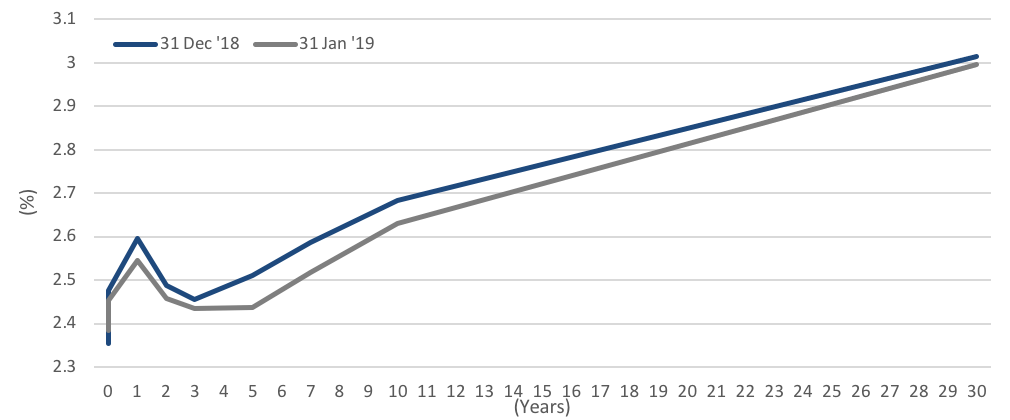

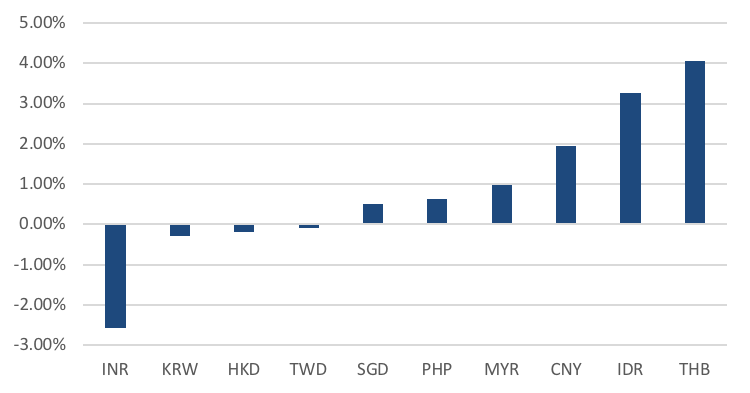

- Amongst AXJ FX, THB (+4.06%), IDR (+3.27%) and CNY (+1.94%) have been leaders YTD (Fig 5). Strength from the Thai baht has been attributed to the 25bp rate hike in December as well as an increase in Thai equity purchases from global funds.

Fig 5: AXJ FX total returns against USD as of 6th Feb ‘19 Source: Bloomberg

Fig 5: AXJ FX total returns against USD as of 6th Feb ‘19 Source: Bloomberg

- CNY strengthened greatly to c.6.70 in January on dollar weakness and optimism around trade, weakening toward the end of the month as this sentiment waned. A few data releases also added to uncertainty over China’s economic trajectory, which also weighed on the currency.

- The course for AXJ FX will be dependent on three aspects, the Fed (US data), the CNY (US-China trade negotiations) as well as the Brent price. We may see some downside pressure over the next month or two until we see a recovery in macroeconomic data. USDCNY’s bounce off its 6.70 resistance in January (and a move back above the 200DMA) implies this. THB will likely hold against its 31.132 resistance, following BOT’s recent decision to leave rates unchanged.

- Much of the directionality for the EUR or the GBP lies in the fate of Brexit. We think that the BoE will unlikely change its monetary policy until there is clarity around Brexit. We expect an extension to Brexit’s deadline, hence reducing the likelihood of a ‘hard’ Brexit. This should be supportive for the GBP in the medium-term.

COMMODITIES – REVIEW

- Brent oil recovered from its 52W low of 50.47 in December to end January at 61.89 on the back of a weaker USD. Venezuelan sanctions contributed to the bullish sentiment around oil, with the cold spell in the US boosting fuel demand. This 15.04% MoM gain was its largest since April 2016, but it now struggles to move past a technical resistance level of 62.80.

- The oil rally since December’s low has also led to significant short covering. ICE data showed that shorts fell 27% in the week ended 29thJanuary to their lowest point since October ’18, while long positions held by hedge funds increased by 15%.

- Oil will remain attractive below its technical resistance of 62.80, but the direction of oil will require clarity on key issues such as China’s economic slowdown and in turn, AXJ’s demand for oil; US’ output and OPEC’s ability (and Russia’s willingness to cooperate) to pull through with their cutbacks in production. These short-term headwinds may only be rectified as we move past 1H19.

- Gold began a new trend, borrowing strength from uncertainty and increased volatility in the markets as we ended 2018. The dim outlook for the dollar at the start of ‘19 also supported gold through the month, as it broke above the $1,300/oz level to end the month at $1,321. However, it failed to break significantly above the $1,320/oz level and pared some of the gains in the first few days of February (Fig 6).

Fig 6: 1Y gold chart Source: Bloomberg

Fig 6: 1Y gold chart Source: Bloomberg

- Dollar strength was the main contributor in Gold’s recent losing streak, but the precious metal has followed its 20DMA rather closely, which suggests that the uptrend may still be intact (Fig 6).

- With investors betting that the Fed may now be on hold, and as the global economy slows and volatility picks up, gold offers an alternative safe haven to FI. Last year, speculative positioning was reduced substantially and central banks bought the most gold since ‘71. With these in mind, we may see gold push higher to test multi-year highs of around $1,360/oz.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Figure 2: Stoxx 600 Total returns against EU indices in April Source: Bloomberg

Figure 2: Stoxx 600 Total returns against EU indices in April Source: Bloomberg

Figure 4: YTD underperformance of MSCI AC ASEAN Index Source: Bloomberg

Figure 4: YTD underperformance of MSCI AC ASEAN Index Source: Bloomberg