[rev_slider alias=”blog”]

Disclosure Statement of Relevant Climate-Related Risks 2023

Odyssey Asset Management Limited (the “Company”) acknowledges that climate change is emerging as a major driving factor affecting long term resilience in the industry and the global economy. Thereby, this creates an urgent need to accelerate the transition towards a...

Disclosure Statement of Relevant Climate-Related Risks

Odyssey Asset Management Limited (the “Company”) acknowledges that climate change is emerging as a major driving factor affecting long term resilience in the industry and the global economy. Thereby, this creates an urgent need to accelerate the transition towards a...

The Japanese government will restart the Go-To Travel Campaign after January 2022

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

Japan to ease entry for businesspeople, students but not tourists

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

Market Update: November 2021

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

Odyssey CEO runs 50km race to raise money for kids with cancer

As the CEO and Co-Founder of the Odyssey Group, the Odyssey team and I strive on a daily basis to give our very best, but there are those who have to fight every day with 100% maximum effort, those kids battling with cancer. I am raising money for a fantastic charity...

Japan moving to reduce restrictions with full relaxation of all border measures by November

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

Market Update: October 2021

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

Market Update: September 2021

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

Market Update: August 2021

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

Market Update: July 2021

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

PART 3: Odyssey Thought Piece – Case Study & Value Proposition – potential REIT Listing

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

PART 2: Odyssey Thought Piece Deep Dive Into Industry Dynamics And Fundamentals

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

PART 1: Odyssey Thought Piece US Student Housing Introduction & the Sector at a Glance

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

Market Update: June 2021

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

Japan 2023 Tourism Recovery Will Be Determined By Inoculation Rate

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

Market Update: May 2021

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

We are Hiring! Managing Director/Director to join our Distribution Team

Role: Managing Director/Director – Distribution Company: Odyssey Asset Management (SG) Pte. Ltd. Location: Singapore Reporting to: Head of Distribution, James Wheeler (based in Hong Kong) Role Summary There is currently an opportunity to join the Odyssey Group,...

Market Update: April 2021

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

Odyssey Thought Leadership Series PART 3: Investment Thesis & Case Study of Ryokans

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

Odyssey thought leadership series PART 2: What are the emerging trends, dynamics and unique selling points of Ryokans?

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

Odyssey thought leadership series PART 1: What are Japanese Ryokan’s, how do they operate and what are the key features?

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

PRESS RELEASE: Odyssey Receives Strategic Investment from ASX Listed Auctus

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and...

Market Update: March 2021

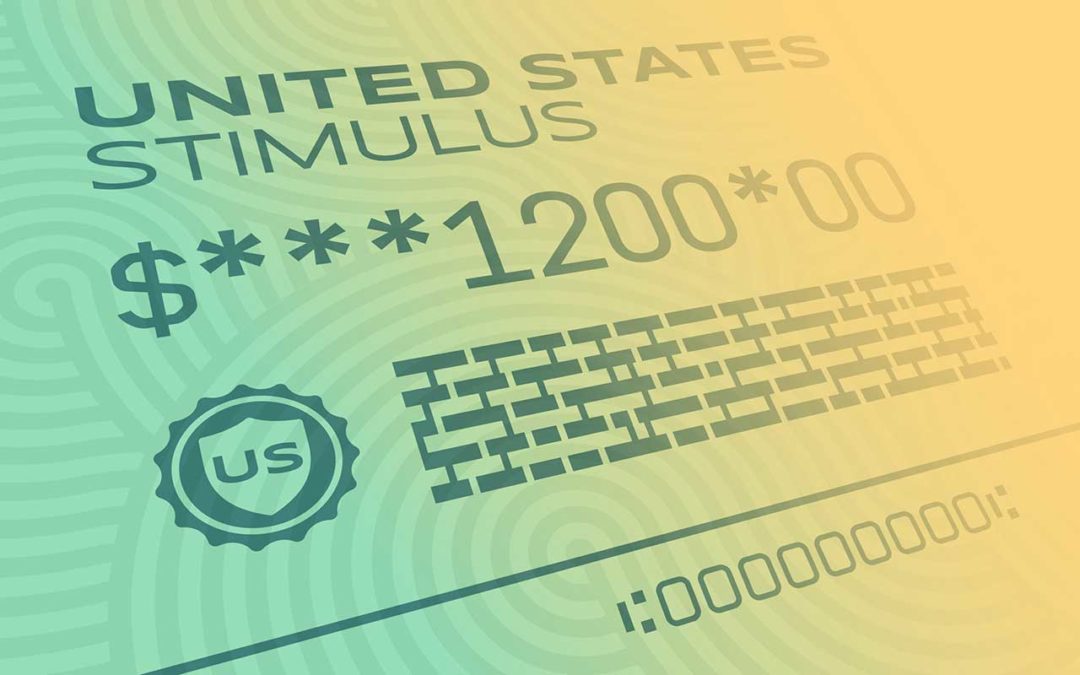

March 2021 Insight Inflation is a Dirty Word If there was one factor that could knock the rally in risk assets on its head is the specter of inflation. That would remove the easy money that has been fueling markets. Right now, it is just the speculation of inflation...

Market Update: February 2021

February Market View Wall Street meets Social Media The evolution of social media has turned into a revolution for the financial markets. Ten years ago, the mostly forgotten Arab Spring showed how nascent social media could galvanise the populace to cause social and...

PRESS RELEASE: オデッセイ・アセット・マネジメント・リミテッド ― 日本不動産部門マネージング ディレクターに垣田宜廣氏を任命

Introducing Mr John Kakita プロフィール 垣田宜廣氏 オデッセイ・アセット・マネジメント・リミテッドはオデッセイ・ジャパン不動産部門担当マネージングディレクターに垣田宜廣氏を任命しました。垣田氏は、ファンドやシンジケートによる新規ホスピタリティアセット買収、そのオペレーション及びマネジメント全般を含めた国内の不動産プロジェクトを統括します。...

PRESS RELEASE: オデッセイジャパンホスピタリティファンドII ローンチのお知らせ

Odyssey Launches 2nd Japanese Hospitality Fund オデッセイジャパンホスピタリティファンドII ローンチ オデッセイ・ジャパン・ブティック・ホスピタリティ・ファンドIでは、過去18ヶ月にかけて有利で魅力的な投資を行ってまいりました。時の経過とともに、目標である8%の利回りと15%のIRRの投資リターンをもたらすことができるとの確信に至っております。そして、このジャパンファンドIの好調を受けて、オデッセイ・ジャパン・ホスピタリティ・ファンドIIが設立されました。...

Market Update: January 2021

January Market View Equity Market Recovery - Historical Context The very optimistic November market sentiment carried over to December. Again, all risk assets recorded robust gains, albeit at a lower rate than the previous month. The big question now is whether the...

Market Update: December 2020

December Market View Christmas Cheer Last month was the best November on record for many major Equity Indices. The MSCI World Index was up 12.2%, even higher than the S&P 500 index, with Europe leading the charge. The MSCI Europe Index jumped 13.8%. Credit and...

Market Update: November 2020

November Market View In God we Trust It appeared there was 2 main factors driving the market on US election day. The first was simply the relief that the event was finally taking place after a nervous S&P 500 had fallen 8% in the prior 3 weeks. The second was a...

Market Update: October 2020

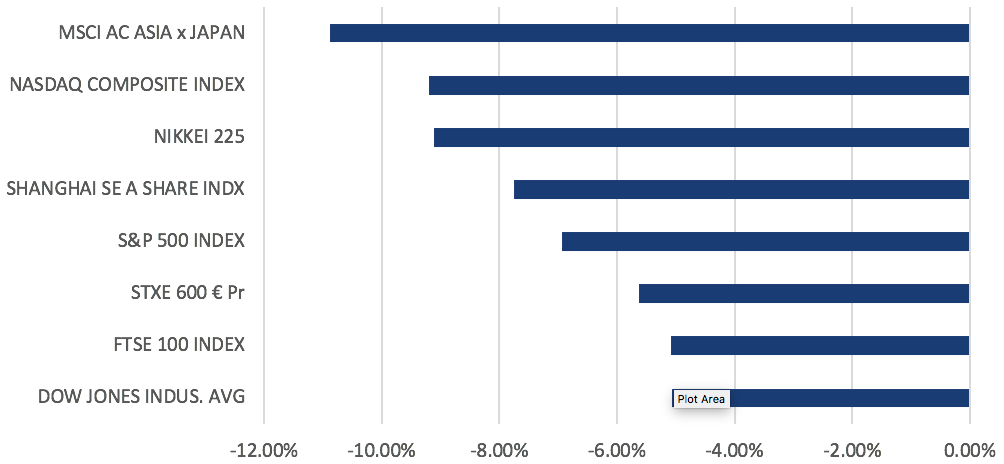

COVID 4 : Governments 2 September was a difficult month for equity markets as MSCI ACWI (developed and EM) dropped -3.4%. Tech stocks were particularly hard hit as the NASDAQ fell -12% from peak to trough before recovery a little to be down -5.2% for the month....

Market Update: September 2020

Market View A Bump, or Something More? August was the 5th strong consecutive month for Equity and risk assets. From the bottom of the equity market in March, the MSCI World Index was up 53% at the end of August. The Index had not seen a drawdown of 5% or more since...

We Are Hiring! Client Support Managers to join our Distribution team

As part of the Odyssey Group’s continued expansion, we are looking to recruit a dynamic Client Support Manager to support the Distribution team. The ideal candidate’s primary duties and responsibilities are as follow: Key Responsibilities Help maintain the...

Market Update: August 2020

Market View The Big Dilemma The current Yield to Worst for the Bloomberg Barclays Global Agg Credit Total Return Index, a Global USD Credit Index, is 1.5%. This may seem a low return, however, fund flow data suggests that investors prefer to get a suboptimal low...

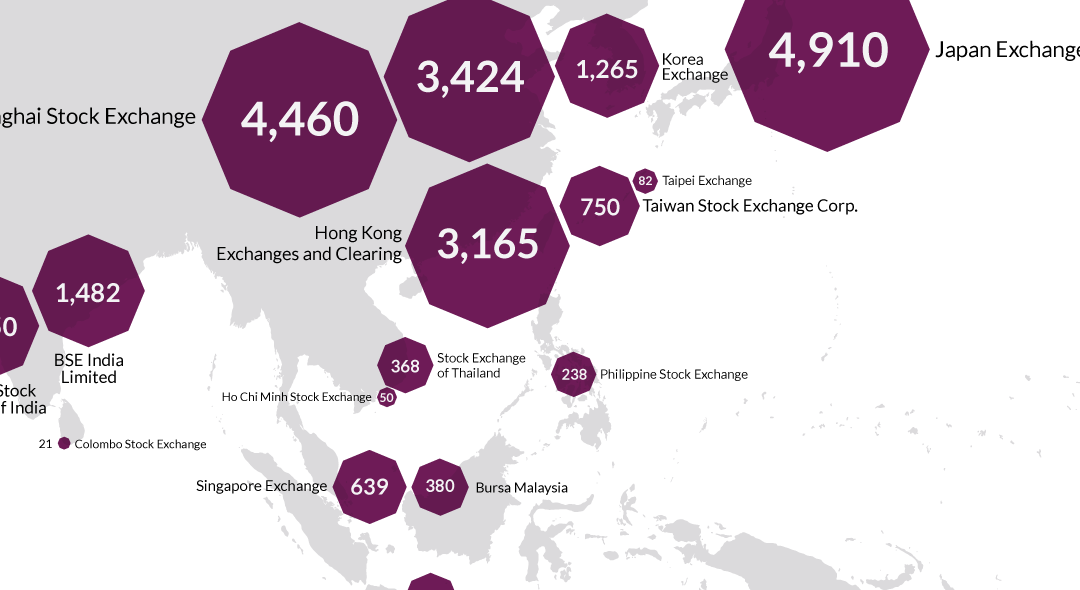

Capital Pulse – July 2020

Welcome to the inaugural issue of Odyssey’s Capital Pulse, Odyssey Corporate Advisory’s quarterly publication that focuses on major capital and financial markets events that occurred during the quarter and its potential implications for you and your business.

Odyssey Corporate Advisory is an independent boutique consultant providing business advisory, investment consultancy, project management and coordination services for companies that intends to access the Hong Kong capital markets.

Market Update: July 2020

Market View Wild Horses In June, risk markets defied rapidly rising new COVID cases in the US and powered higher. Admittedly, the 1.8% rise in the S&P 500 was primarily driven by a 7% rise in the Information Technology and a 5% rise in Consumer Discretionary...

LEX CAPITIS – June 2020

Welcome to the May issue of Odyssey's Lex Capitis, Odyssey Corporate Advisory's publication that highlights capital and financial markets developments and its potential implications for you and your business. Odyssey Corporate Advisory is an independent boutique...

Market Update: June 2020

Market View - The Old Normal Our caution last month proved to be unfounded. The power of the unprecedented stimulus, zero interest rates and the prospect of loosening of lockdown restrictions won the battle against extreme lows in economic activity and the prospect of...

The Odyssey Group partners with K2 Asset Management to provide Discretionary & Advisory portfolio Services

Odyssey Group Ltd is pleased to announce the partnership with the Australian Stock Exchange listed, K2 Asset Management (ASX Code: KAM). Odyssey is constantly seeking ways to drive value for its clients and has been researching solutions to further develop its asset...

We Are Hiring! Private Bankers to join our Wealth Management team

Odyssey Group is Asian’ leading independent Alternative Asset Manager. We are currently expanding its External Asset Management (EAM) Platform and are actively inviting experienced Private Bankers and Wealth Managers to join this market leading platform. ROLE...

LEX CAPITIS

Lex Capitis Odyssey Corporate Advisory’s periodical that highlights capital and financial markets developments and its potential implications for you and your business. Odyssey Corporate Advisory is an independent boutique consultant providing business advisory,...

Market Update: May 2020

Market View The equity markets have been buoyant for the last 6 weeks. Global virus cases have peaked and many countries have started a tentative process of loosening lockdown restrictions. To assist the recovery, G20 countries have announced a stimulus program that...

Capital Pulse

Welcome to the inaugural issue of Odyssey’s Capital Pulse, Odyssey Corporate Advisory’s quarterly publication that focuses on major capital and financial markets events that occurred during the quarter and its potential implications for you and your business.

Odyssey Corporate Advisory is an independent boutique consultant providing business advisory, investment consultancy, project management and coordination services for companies that intends to access the Hong Kong capital markets.

Market Update: April 2020

Outlook Despite heightened worries about the impact of the virus on the US, we believe data is consistent with our base case (60% probability) in which new virus cases peak by mid-April in Europe and the US; the most severe restrictions are lifted from May; and a...

Market Update: March 2020

February was a tumultuous month for markets, which saw an elevated level of volatility across asset classes that extended even further into early March. Just as the coronavirus appeared to have come under some extent of control in China and other regions, Italy, South...

Odyssey View: Corona Virus, Horizon Discretionary Portfolios & the Global Markets

Timeline of Concern US equity markets have had their worst week since 2008. The S&P500 has tumbled 13% since its peak on the 19th February, a mere 7 trading days ago. The sell-off was broad-based with no sectors spared. The market impact of the CoronaVirus, or...

Market Update: February 2020

Markets were risk on at the start of January on the back of optimism around the successful signing of the US-China phase one deal and the easing of US-Iran tensions. However, that was quickly forgotten and reversed following the coronavirus outbreak, which led to an...

Market Update: January 2020

All asset classes had an extraordinary year in ’19 with most far surpassing their 10-year averages (Figure 1). Geopolitical uncertainty saw various asset classes move sideways for almost the first half of the year, but markets picked up once we saw clarity. Equities...

Market Update: December 2019

Markets traded mostly higher in November on the back of improving trade headlines and despite Trump’s signing of the Hong Kong Human Rights and Democracy Act and potential sanctions against Chinese officials for abuse against the Uighur Muslims. We saw indices in the...

Market Update: November 2019

A myriad of positive factors pushed global equities higher, with the MSCI ACWI seeing a total return of 2.76% over the month, before moving higher month-to-date (MTD) in November (+1.35% MTD as at 5th November). This move higher was supported in part by the three US...

Market Update: October 2019

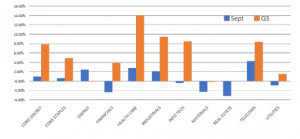

Markets saw a risk-on rotation in September (Figure 1) amid positive trade developments earlier in the month. China suspended tariffs on 16 types of US products, while the USA delayed tariff hikes from 1st October to 15th October in order to avoid China's 70th...

We Are Hiring! Client Development Executive

With the rapid expansion of Odyssey Asset Management division within the Odyssey Group, an opportunity has come up for a Client Development Executive role in the Distribution team. The role will be an integral member of the Distribution team working closely with the...

We are Hiring! Customer Relationship Manager

With the rapid expansion of Odyssey Asset Management division within the Odyssey Group, an opportunity has come up for a Customer Relationship Manager to join the team. The role will be an integral member working closely with the Directors and key stakeholders of the...

We are hiring! Chief Compliance Officer

As part of the Odyssey Group's continued expansion, we are hiring a new Chief Compliance Officer (CCO) for the firm. The CCO will oversee the group's compliance and risk operations and policies. The following is a summary of the role and responsibilities....

Are You A Private Banker Or Wealth Manager?

Odyssey Capital Group is expanding our External Asset Management (EAM) Platform and we are actively inviting experienced Private Bankers and Wealth Managers to establish their own wealth practice. ROLE SUMMARY: You will be responsible for bringing in new accounts and...

Market Update: September 2019

August was, as expected, a tricky month for risk assets as geopolitical issues continued to sway markets, forcing investors into safe-haven assets amid escalating trade tensions, the Brexit debacle, and a string of weak macroeconomic data releases. Equity markets were...

NHK World TV: Nishi-Nippon Railroad Features Port Moji

As Japan continues to experience exponential growth in tourism, tourists are more frequently leaving the major cities and venturing out into the various islands, hidden away prefectures and charming outer regions. Fukuoka prefecture, in the southern part of Japan is...

Are you interested in an Internship at Asia’ leading Alternative Asset Manager?

Odyssey has cultivated a robust and esteemed intern program that has seen the company train and mentor +40 interns over the last 24 months. The Odyssey Group has been rapidly growing and expanding throughout the region and continues to look for aspiring interns who...

Market Update: August 2019

Last week saw the heaviest sell-off in the S&P 500 (the worst since Dec ’18), with US indices seeing sharp pullbacks into early August just shortly after making fresh all-time highs in the last week of July. A re-escalation of Sino-US trade tensions, as well as a...

Odyssey partners with New York-based Cadre to provide new property opportunities to clients

Partnerships Odyssey has recently partnered with New York-based Cadre, a technology-enabled real estate investment platform, to allow Odyssey’s private wealth management clients to invest in Cadre’s syndicated property opportunities. Cadre leverages technology to make...

Market Update: July 2019

June was a robust month for risk assets with equities rallying on a more ‘dovish’ Fed that shifted from talking about more accommodation to Powell effectively telling markets the Fed will cut rates July – the question now being 25bps or 50bps, and whether it is ‘one...

Asia.Nikkei.com: Tourism market in rural areas in Japan with the highest growth

[Foreign tourists in Japan visiting rural areas like Kanazaka, no longer limiting themselves to metropolitan cities such as Osaka and Tokyo. (Photo by Nobuyoshi Shioda)] From Nikkei Asian Review: "Foreign tourist consumption in Japan -- including travel expenditures...

AsianPrivateBanker.com: Odyssey AM hires banker from Indosuez to build out NRI business

From AsianPrivateBanker.com: Odyssey Asset Management, the wealth management subsidiary of alternative asset manager Odyssey Group, has hired a former Indosuez WM banker to build out its NRI division, Asian Private Banker can reveal. Mullikkottu Veetil Ramadasan has...

Asia.Nikkei.com: Japan awaits big wave of Southeast Asian tourists

[Thai tourists find their nirvana at a Buddhist temple in Takayama, Gifu Prefecture, central Japan.] From Asia.Nikkei.com: "Thai tourists to Japan topped 1 million in 2018, while their Vietnamese and Filipino counterparts also came over in large numbers. What is even...

Asia.Nikkei.com: Japan awaits big wave of Southeast Asian tourists

[Thai tourists find their nirvana at a Buddhist temple in Takayama, Gifu Prefecture, central Japan] From Asia.Nikkei.com: "Thai tourists to Japan topped 1 million in 2018, while their Vietnamese and Filipino counterparts also came over in large numbers. What is even...

Market Update: June 2019

Equities were hit hard last month after sentiment soured after a rapid about-turn on a US-China trade deal that was expected to be signed. The US blamed it on a U-turn by the Chinese leadership that worried the deal, as it stood, might be seen as ‘humiliating’....

Japan Fund Presentation

Odyssey Japan Boutique Hospitality Strategy 2019 1H

Daimon Brewery Update: May 2019

With the recent passing of the Japanese Golden Week holiday, I wanted to send you all a warm welcome to the new era - REIWA. This was officially on 1st May, where we launched the new era for Japan and one for Daimon Brewery as well! With our namesake the RIKYUBAI...

Bloomberg.com: Private Equity Firms Eye Opportunity in Japan’s Traditional Hot Baths

[An outdoor bath at Shosenkaku Kagetsu, Yuzawa] From Bloomberg.com: "Private equity funds like Softbank-owned Fortrsess Investment Group LLC and Hong Kong-based Odyssey Capital Group are spending billions to tap into the appeal of traditional inns amid a tourism boom...

Market Update: May 2019

April found equities in good health, led up by the S&P 500 (+3.93% MoM) and followed by Stoxx (+3.23% MoM) on a combination of trade optimism, 'dovish' central banks' rhetoric and better earnings off Q1FY19 results. Asia ex-Japan (AXJ)/Emerging markets (EM)...

Protected: New Syndicate Opportunity: Japanese Boutique Hospitality Investment

Password Protected

To view this protected post, enter the password below:

Odyssey Launches Asia Focused Third Party Fund Distributor – CapConnectAsia

Odyssey Launches Asia Focused Third Party Fund Distributor – CapConnectAsia CapConnectAsia will seek to connect best-in-class global fund management groups with the increasingly vital pool of Asian capital. The business has been launched to capitalise on the trend...

Asia.Nikkei.com: Japan gets more than it bargained for with tourist boom

[Japanese and International tourists enjoy the Cherry blossoms in Kyoto] From asia.nikkei.com: “....In 2018, foreign visitor arrivals jumped 8.7% to 31.19 million from a year earlier. And as Japan sprints toward two major sporting events -- the Rugby World Cup from...

Market Update: April 2019

“Ultimately lower rates are only good to a point because, eventually, the fall in rates is not just about the Fed giving equity investors a "green light" to load up on risk, but also indicates concerns around GDP growth.” `– MORGAN STANLEY Look through or come off....

Australian Budget Update: April 2019

The 2019 Australian Federal Budget was handed down by Treasurer Josh Frydenberg on Tuesday, 2nd April announcing the Federal Budget will be back in the black for the first time in twelve years, with a budget surplus of A$7.1 billion dollars forecast for 2019/2020....

Scmp.com: Hong Kong companies eye slice of Japan tourism boom, invest in hospitality sector

[Tourists in the overcrowded tourist destination Sensoji, Tokyo] From Scmp.com: “A boom in the tourism sector has seen significant growth in both the macroeconomy and Japan’s hospitality sector,” said Christopher Aiello, manager of Hong Kong-based Odyssey Capital...

Market Update: March 2019

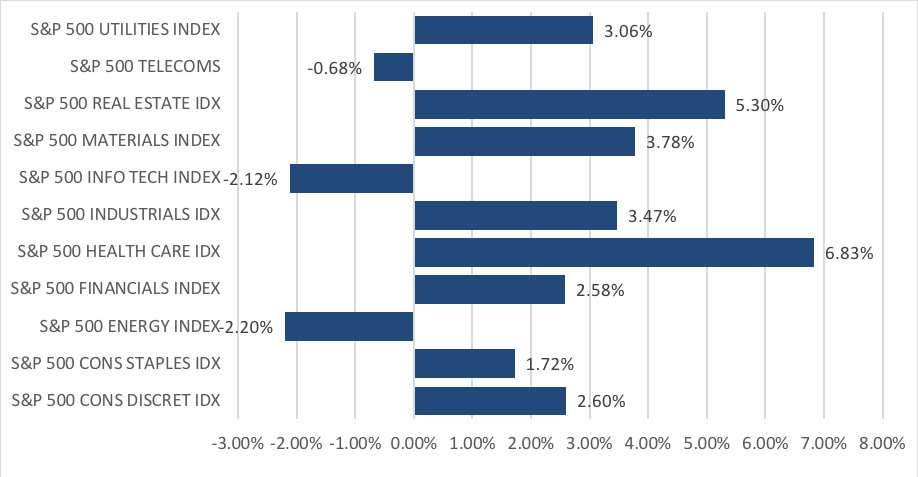

The rally for equities continues after the best January in over 30 years, defying the gloomy consensus seen at the end of 2018 as the S&P 500 (+ 3.0%), NASDAQ (+3.4%) and Dow (+3.7%) gained MoM alongside other major markets which were also up by 2-3%. The...

JapanToday.com: Bank of Japan to maintain low interest rates

[Bank of Japan Governor Haruhiko Kuroda, left, meets with Japan's Prime Minister Shinzo Abe] Abe to leave monetary policy up to BOJ chief Kuroda From JapanToday.com: Japanese Prime Minister Shinzo Abe said on Monday that he trusted Bank of Japan Governor Haruhiko...

JapanToday.com: Number of foreign visitors to Japan rises 7.5% to 2.69 mil in January

Record tourism flows in January during Japan's coldest and quietest month of the year. From JapanToday.com: The estimated number of foreign visitors to Japan in January increased 7.5 percent from a year earlier to 2,689,400, an all-time high for the month, supported...

PRESS RELEASE: Odyssey Japan Boutique Hospitality Fund Completes 1st Close

Odyssey Asset Management Limited, is pleased to announce that it has successfully completed the first-close of the Odyssey Japan Boutique Hospitality Fund. The Odyssey Japan Boutique Hospitality Fund is a unique, private equity-real estate fund focused on the...

Nikkei Shimbun: Anticipating increases of tourists to Japan, investment firms launch funds to rebuild Japanese-style hotels in provincial cities

[Translated from Japanese, as published in the Nikkei Shimbun] 2019/1/23 21:00 | Nikkei Shimbun Fund managers are actively acquiring Ryokans (Japanese-style hotels) in provincial cities. Odyssey Capital Group Limited, from Hong Kong, launched an investment fund...

Market Update: February 2019

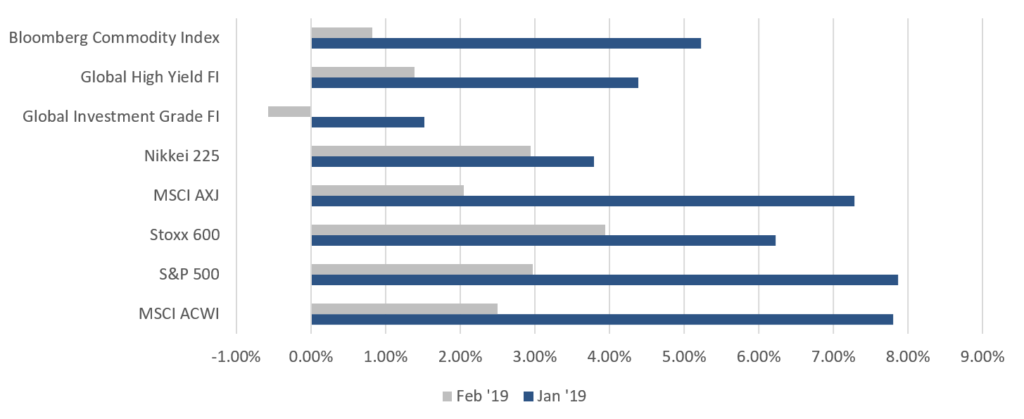

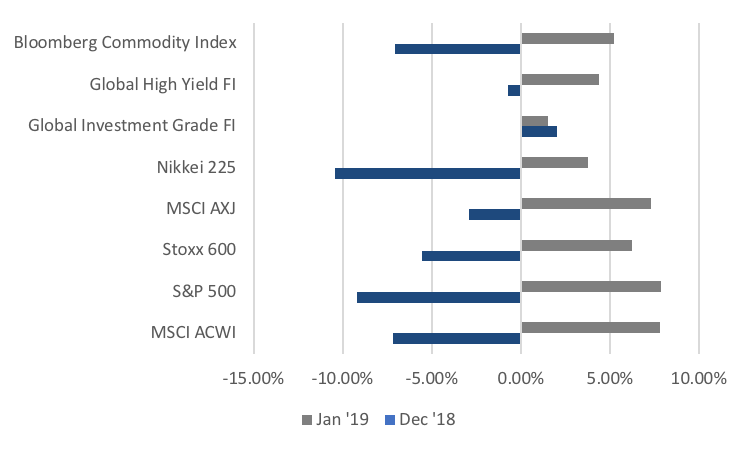

Risk assets rebounded strongly in January after a horrific December (Fig 1). The MSCI ACWI gained 7.80% in January, its largest gain since October 2011. This came after December’s fall of -7.17%, the second-largest fall since May 2012. A more significant comparison...

The Japan Times: Tourists to Japan hit record 31 million in 2018

As seen on The Japan Times: The estimated number of overseas visitors to Japan reached a record high 31.19 million in 2018, up 8.7 percent from the previous year and rising for the seventh straight year, the tourism minister said Friday. Land, Infrastructure,...

Market Update: January 2019

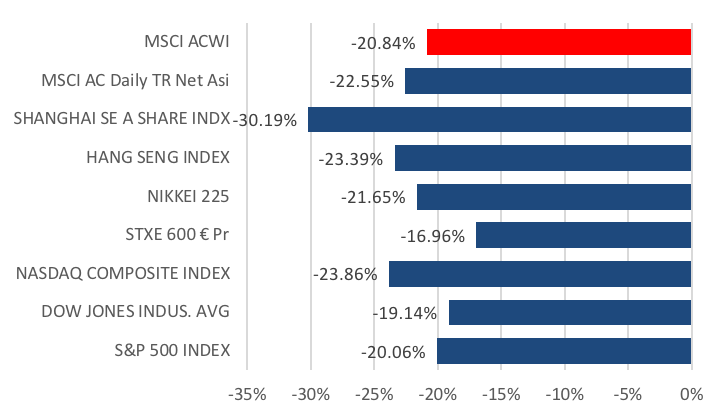

Equities fell momentarily into a technical bear market on Christmas Eve amidst growing concerns that the Fed is raising rates into a slowing global economy, evidenced by weaker manufacturing and other various economic data released over the month. Thin trading through...

Q4 2018 Review: Odyssey Japan Boutique Hospitality Fund

The Japan Boutique Hospitality Fund got off to a successful and promising start in 2018 and the fourth quarter was a busy period in terms of acquisitions and preparing the deal pipeline for accelerated activity in 2019. At the end of October (2018) we acquired a...

Market Update: December 2018

Global equity markets recovered slightly from the October sell-off, with the MSCI All Country World Index ending November +1.30%. However, while investors stuck with equities, global trade and geopolitical events led them to remain defensive. This month saw a...

Market Update: November 2018

Despite the month-end window dressing, October was a bad month for equities. Indices in the major regions all closed significantly lower within the range of -5% to -11%, with MSCI AXJ leading declines (Figure 1). This month was also the worst October since ’08, where...

Press Release: Odyssey Japan Boutique Hospitality Fund & Shinhan announces acquisition of Owan Hotel

Odyssey Capital Group Ltd is pleased to announce that the Odyssey Japan Private Equity Real Estate division has been selected by Shinhan Investment Corp (a division of Shinhan Financial Group) to be their Japan Hospitality Advisor and Fund Manager for an...

Market Update: October 2018

More US Trade tariffs on China, Italy’s debt problem, the Federal Open Market Committee (FOMC) meeting, Liberal Democratic Party (LDP) leadership and Sweden's election all made September an interesting month for news, but most had a relatively little impact across...

Press Release: Odyssey Japan Boutique Hospitality makes first Asset Acquisition

Dear Clients & Friends, We are very pleased to announce that, as part of our Japanese Boutique Hotel strategy, we have made our first acquisition, a uniquely charmingRyokan (traditional Japanese inn) called “Kagetsu” in Echigo Yuzawa, Niigata Prefecture - see the...

The Odyssey Team Wish you a fun-filled and joyous Mid-Autumn Festival

Monthly Market Update – September 2018

SEPTEMBER 2018 September started badly for equities outside the US, especially for EM equities outside AXJ, and the IT sector within US equities. Trade fears over whether the US will impose 25% tariffs on a further $200bn of imports from China last week and roll-out...

Monthly Market Update – August 2018

MACRO - REVIEW Equities mostly had a slightly better month in July with strong Q2FY18 results helping S&P 500 (SPX) up 3.5%, while NASDAQ rose just over 2% but for US IT, some of the recent moves have been stark: at one point, FACEBOOK led the FAANGs down 9.6% in...

Monthly Market Update – July 2018

HOW WE ARE POSITIONED FOR 3Q18 It was a choppy and volatile month as US President Trump announced a 25% levy on $50 billion of imports from China, who likewise responded with similar measures. Stakes were raised toward month-end as the US threatened additional import...

Monthly Market Update – June 2018

HOW WE ARE POSITIONED FOR THE END OF Q2 2018 Global equities had a choppy and volatile month as initial strong gains gave way to profit taking in May. US equities, fuelled by a positive 1Q earnings season, outperformed the rest of the world; while European equities,...

![[Press Release] Fund to convert Japan’s historic architecture into luxury boutique hotels](https://odyssey-grp.com/wp-content/uploads/2018/06/ryokan_5_resized.jpg)

[Press Release] Fund to convert Japan’s historic architecture into luxury boutique hotels

WILLIAMS MEDIA sat down with Christopher Aiello, Fund Manager of the Odyssey Japan Boutique Hospitality Fund about their latest alternative real estate strategy. The Odyssey Japan Boutique Hospitality Fund, launched on 16 May, aims to preserve and transform historical...

Monthly Market Update – May 2018

HOW WE ARE POSITIONED FOR THE REST OF Q2 2018 After the sell off in February and March, the global stock market had a positive run up in April. While the European and Japanese markets completed a strong bounce, the US and the rest of Asia underperformed. While the...

PRESS RELEASE: The Flying Winemaker lands in New Zealand with the acquisition of Gladstone Vineyard by Odyssey Capital Group

FOR IMMEDIATE RELEASE The Flying Winemaker lands in New Zealand with the acquisition of Gladstone Vineyard by Odyssey Capital Group 11 May 2018 Leading Wairarapa wine producer Gladstone Vineyard is entering a new chapter as the business is set to be acquired by...

Monthly Market Update – Apr 2018

HOW WE ARE POSITIONED FOR THE BEGINNING OF Q2 2018 After the wild gyrations and heavy plunges in February, we experienced more downside in March. Since then, there has been a number of disturbing news releases which we expect will see the heightened market volatility...

Monthly Market Update – Mar 2018

HOW WE ARE POSITIONED FOR THE END OF Q1 2018 After the wild gyrations and heavy plunges in the markets in February, we remain considerably cautious and expect the new volatile environment to stay. The markets took a fright from the sudden spike up in bond yields and a...